What is KernelDAO (KERNEL) Crypto Coin? A Clear Guide to Restaking and Multi-Chain Yield

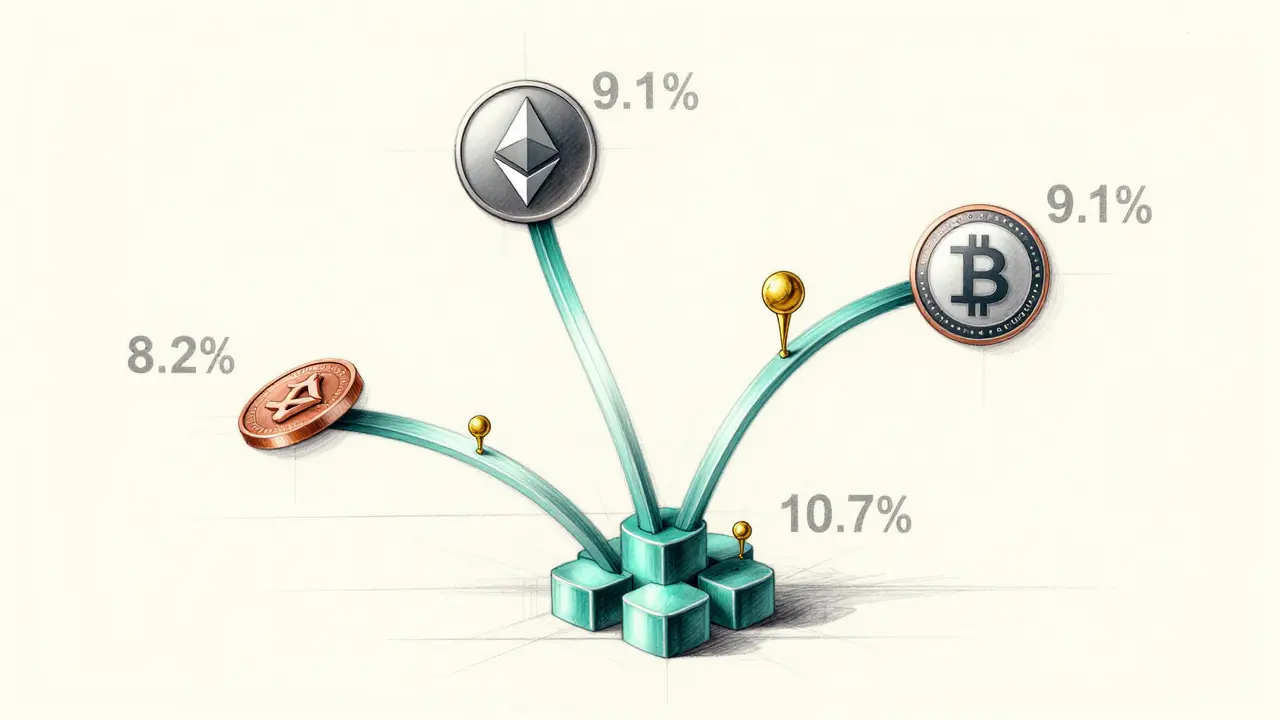

KernelDAO (KERNEL) isn’t just another crypto coin. It’s a protocol built to solve one of the biggest frustrations in DeFi: capital inefficiency. If you’ve ever staked your ETH or BNB and felt like your assets were sitting idle, locked away with no way to earn more, KernelDAO is designed for you. Launched in April 2025, it lets you use the same crypto assets to earn rewards on multiple blockchains at once-without locking up extra money. This isn’t theory. Real users are earning 8-12% APY by combining staking, restaking, and automated yield farming-all from one wallet.

What Exactly Is KernelDAO?

KernelDAO is a decentralized restaking protocol. That means it lets you take assets you’ve already staked-like stETH or bETH-and use them again to secure other networks. Think of it like renting out your car to two different ride-share apps at the same time. You’re not buying a second car. You’re just letting the same one work harder.

Traditional staking locks your crypto to one chain. If you stake Ethereum, you earn ETH rewards, but your ETH can’t help secure Solana, BNB Chain, or Arbitrum. KernelDAO breaks that rule. It connects three groups:

- Token holders who want more yield

- Validators who need more security deposits

- Actively Validated Services (AVS) like lending apps or oracle networks that need reliable validation

By linking these groups, KernelDAO turns your staked assets into multi-use tools. Your stETH doesn’t just earn Ethereum rewards-it can also help secure a DeFi lending protocol on BNB Chain or a bridge on Arbitrum. And you get paid for all of it.

The KERNEL Token: More Than Just a Currency

The KERNEL token is the engine that keeps KernelDAO running. It’s not a speculative coin-it’s a utility token with three clear roles:

- Governance - KERNEL holders vote on protocol upgrades, new chain integrations, and validator selection. If you hold KERNEL, you help decide where the protocol goes next.

- Incentives - Users and validators earn KERNEL rewards for participating. The more you restake, the more you get.

- Staking - You can lock up KERNEL to boost your rewards across all KernelDAO products. Staking KERNEL gives you higher APY and extra voting power.

As of December 2025, over 45% of KERNEL tokens are staked by users, showing strong long-term commitment. The token supply is fixed at 1 billion, with 20% allocated to early users and validators. No team tokens are locked longer than 24 months, reducing centralization risk.

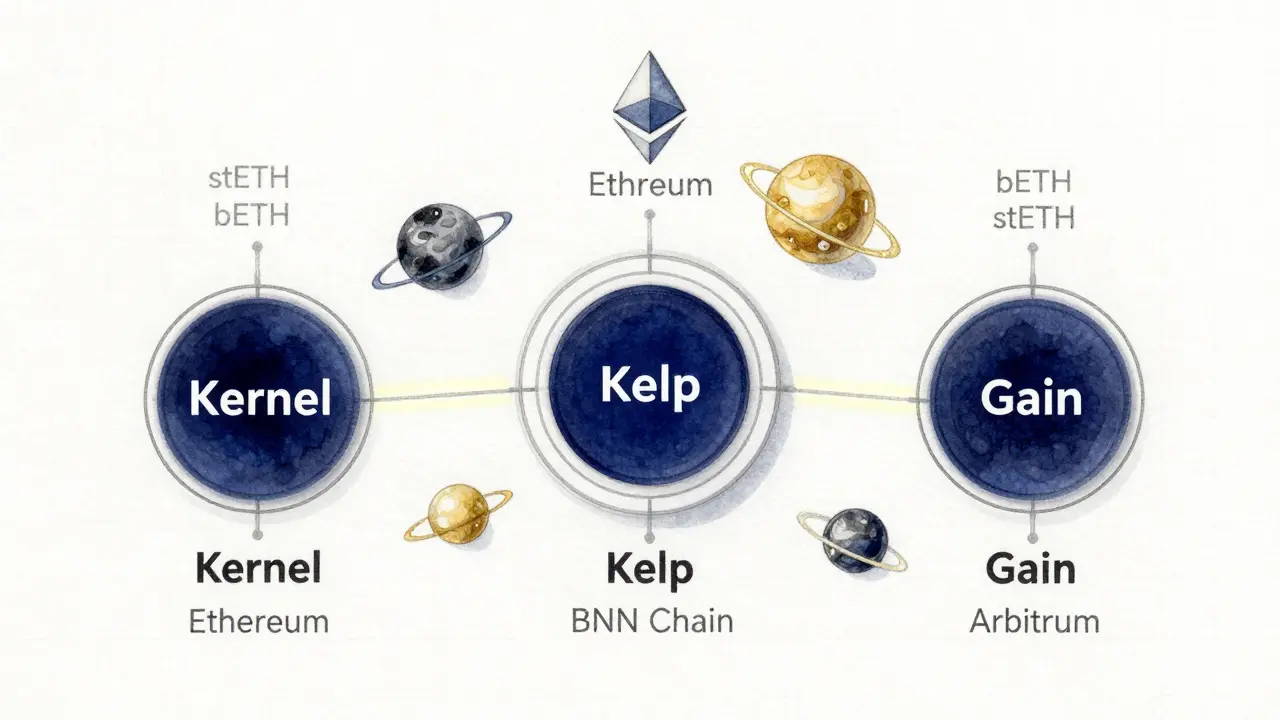

How KernelDAO Works: Kernel, Kelp, and Gain

KernelDAO isn’t one tool-it’s three. Each serves a different purpose, but they all connect to the same core system.

Kernel: Restaking on BNB Chain

This is the main entry point. You deposit liquid staking tokens (LSTs) like stETH or bETH. Kernel then restakes them across BNB Chain’s Dynamic Validation Networks (DVNs). These DVNs support dozens of DeFi apps, from lending to derivatives. Users report average yields of 7.5-9% APY here, plus extra rewards from partner protocols.

Kelp: Liquid Restaking for Ethereum

Kelp lets you stake ETH directly and get rsETH in return. rsETH is a liquid token that tracks your staking rewards in real time. You can trade it, use it in DeFi, or hold it-all while earning ETH staking rewards and extra yield from restaking. It’s like having your cake and eating it too.

Gain: Automated Yield Optimization

Gain is the smart layer. It takes your restaked assets and automatically moves them across 50+ DeFi protocols to chase the highest yields. It handles compounding, rebalancing, and gas optimization. Users who used Gain saw their APY jump by 1.2-1.8% in late 2025 after automated compounding was added.

These three products work together. You can stake ETH via Kelp, restake the rsETH via Kernel, and let Gain farm the rest. It’s a full-stack yield machine.

How KernelDAO Compares to Other Restaking Protocols

KernelDAO isn’t the only player. But it’s the only one built for multi-chain from day one.

| Protocol | Primary Chain | TVL | Multi-Chain? | DeFi Integrations | Best For |

|---|---|---|---|---|---|

| KernelDAO | Ethereum, BNB Chain, Arbitrum | $2.1B | Yes (10+ chains) | 50+ | Users wanting cross-chain yield |

| EigenLayer | Ethereum | $15.7B | No | 30+ | Large ETH holders, institutions |

| Renzo | Ethereum | $1.2B | No | 20+ | Liquid restaking on Ethereum only |

| Puffer Finance | Ethereum | $850M | No | 15+ | Simple ETH restaking |

KernelDAO’s edge? It’s not trying to beat EigenLayer on Ethereum. It’s building a bridge between Ethereum, BNB Chain, and others. Over 68% of its users are active on BNB Chain, making it the top restaking option for that ecosystem. If you’re already using BNB Chain DeFi apps, KernelDAO gives you access to Ethereum-level security without leaving your favorite chain.

Who Is KernelDAO For? (And Who Should Stay Away)

KernelDAO is powerful-but it’s not beginner-friendly.

Good fit:

- You’ve used DeFi before (Uniswap, Aave, Curve)

- You understand liquid staking tokens (stETH, rsETH, bETH)

- You’re comfortable connecting wallets and approving transactions

- You want to maximize yield across multiple chains

Not a fit:

- You’re new to crypto and still learning what staking is

- You want simple, one-click staking

- You’re uncomfortable with smart contract risk

On MEXC, 78% of positive reviews mention high yields. But 63% of negative reviews say the interface is confusing. Reddit users report spending 2-3 weeks learning the system before feeling confident. If you’re not ready to read documentation and watch tutorials, you’ll get lost.

Security and Risks

KernelDAO is non-custodial. That means you control your keys. No third party holds your crypto. But because it operates across 10+ blockchains, it has more attack surfaces.

OpenZeppelin audited Kernel’s core contracts in 2025 and found no critical flaws. But CertiK warned in November 2025 that “each chain adds unique vulnerabilities.” A bug on Arbitrum could theoretically affect users on BNB Chain if the shared security layer is compromised.

Another risk: unbonding periods. If you want to withdraw, you might wait 7-14 days depending on the chain. One Reddit user lost two weeks of rewards by unstaking too early. Always check the lock-up time before acting.

Regulatory risk exists too. Some countries may classify restaking rewards as securities. KernelDAO’s decentralized governance helps, but it’s not a legal shield.

How to Get Started

Here’s how to start using KernelDAO in 5 steps:

- Get a Web3 wallet (MetaMask, Trust Wallet)

- Buy ETH, BNB, or a liquid staking token like stETH or bETH

- Go to kerneldao.com and connect your wallet

- Choose your product: Kernel (for BNB Chain), Kelp (for Ethereum), or Gain (for automated yield)

- Deposit your tokens and confirm the transaction

Start small. Try restaking $50 worth of stETH on Kelp first. Watch how rsETH behaves. Then move to Kernel. The Discord community (42,000+ members) has step-by-step guides and live support.

What’s Next for KernelDAO?

KernelDAO’s roadmap is aggressive:

- Q1 2026: Mobile app release

- Q1 2026: New governance feature letting KERNEL holders propose new chain integrations

- Q2 2026: Integration with 15 more DeFi protocols

- 2026: Potential integration with Bitcoin Layer 2s

Messari projects KernelDAO could hit $5 billion in TVL by Q3 2026 if multi-chain restaking keeps growing at 35% per quarter. That’s a big “if,” but the trend is clear: users are tired of choosing between chains. They want to use their crypto everywhere-and KernelDAO is one of the few protocols built for that reality.

Final Thoughts

KernelDAO (KERNEL) isn’t a coin you buy to flip. It’s a tool you use to earn more from crypto you already own. If you’re serious about DeFi and tired of leaving your assets idle, it’s worth exploring. But don’t jump in blind. Learn the products. Understand the risks. Start small.

By December 2025, over 210,000 unique wallets have interacted with KernelDAO. That’s not a moonshot. It’s a steady rise by users who value efficiency over hype. If you’re one of them, KernelDAO might be the next step in your DeFi journey.

Is KernelDAO safe to use?

KernelDAO is non-custodial, meaning you control your funds. Its core contracts have been audited by OpenZeppelin, and no critical exploits have been found. However, because it operates across 10+ blockchains, it has more potential attack surfaces than single-chain protocols. Always use a trusted wallet, never share your seed phrase, and start with small amounts until you’re confident.

Can I earn rewards without staking KERNEL?

Yes. You can earn yield from restaking ETH, BNB, or liquid staking tokens through Kernel, Kelp, or Gain without owning any KERNEL tokens. But if you stake KERNEL, you unlock higher rewards, priority access to new features, and voting power in governance.

What’s the difference between staking and restaking?

Staking means locking your crypto to secure one blockchain and earn rewards (like staking ETH on Ethereum). Restaking means using those already-staked assets to secure other networks or services. With restaking, your crypto works harder-you earn from multiple sources without locking new funds.

How do I get KERNEL tokens?

KERNEL tokens are distributed as rewards for using KernelDAO’s products (Kernel, Kelp, Gain). You can also buy them on major exchanges like MEXC, Bybit, and OKX. As of December 2025, the token is not available on Coinbase or Binance.US due to regulatory uncertainty.

Is KernelDAO better than EigenLayer?

It depends on your goals. EigenLayer has more TVL and is the leader in Ethereum restaking. But KernelDAO offers multi-chain support-especially strong on BNB Chain-and integrates with 50+ DeFi protocols. If you only use Ethereum, EigenLayer is fine. If you use multiple chains, KernelDAO gives you more options and better yield opportunities.

What happens if a chain KernelDAO uses gets hacked?

KernelDAO’s design isolates risk as much as possible. If one chain (like Arbitrum) is compromised, it doesn’t automatically affect assets on BNB Chain or Ethereum. However, if the shared security layer connecting them is breached, users across all chains could be impacted. This is why audits and multi-chain security are critical-and why KernelDAO prioritizes them.

Rishav Ranjan

December 21, 2025 AT 18:10Naman Modi

December 23, 2025 AT 09:49Aaron Heaps

December 23, 2025 AT 13:25roxanne nott

December 25, 2025 AT 08:11Steve B

December 27, 2025 AT 06:47Sophia Wade

December 28, 2025 AT 15:10Cathy Bounchareune

December 28, 2025 AT 22:21Jake Mepham

December 29, 2025 AT 12:37Rachel McDonald

December 31, 2025 AT 01:13Sybille Wernheim

December 31, 2025 AT 05:29Dustin Bright

January 1, 2026 AT 20:52Shubham Singh

January 3, 2026 AT 12:40Collin Crawford

January 4, 2026 AT 11:38Jordan Renaud

January 4, 2026 AT 14:49Sarah Glaser

January 4, 2026 AT 20:19Melissa Black

January 5, 2026 AT 19:21Megan O'Brien

January 7, 2026 AT 00:49Jayakanth Kesan

January 7, 2026 AT 02:24Craig Fraser

January 7, 2026 AT 23:27Lloyd Yang

January 9, 2026 AT 04:56Zavier McGuire

January 9, 2026 AT 15:44Dan Dellechiaie

January 10, 2026 AT 18:56Helen Pieracacos

January 12, 2026 AT 06:15Tristan Bertles

January 13, 2026 AT 23:25Jacob Lawrenson

January 15, 2026 AT 11:45Ashley Lewis

January 15, 2026 AT 20:15Charles Freitas

January 16, 2026 AT 09:16Grace Simmons

January 17, 2026 AT 07:58Sheila Ayu

January 17, 2026 AT 14:17Janet Combs

January 17, 2026 AT 22:31