Axiome (AXM) Crypto Coin Explained - Features, Tokenomics & Price

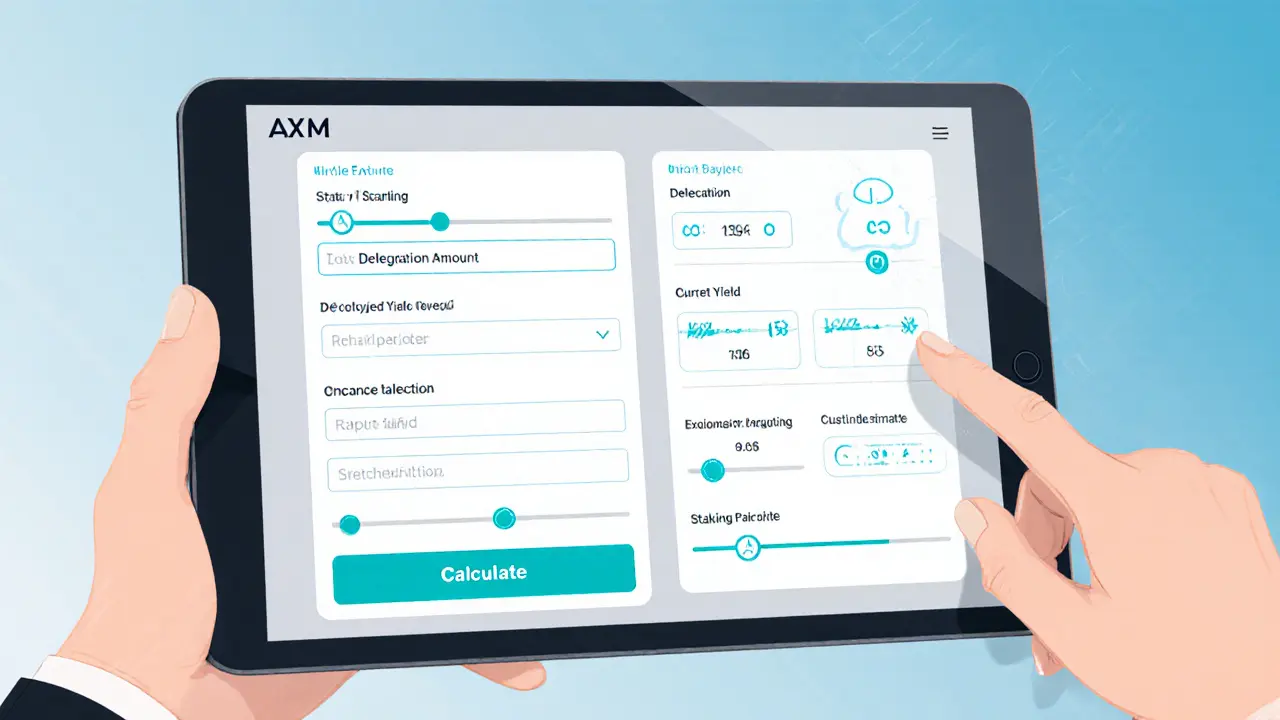

AXM Staking Reward Calculator

Estimate your potential monthly staking rewards for Axiome (AXM) tokens. Enter your delegation amount below and see how much you could earn with current yield rates.

Estimated Monthly Rewards

With 0 AXM delegated at 0% yield:

Monthly Reward:

$0.00

Annualized Reward:

$0.00

About AXM Staking

AXM holders can delegate tokens to validators and earn:

- Newly minted AXM tokens

- A share of network fees (paid in stablecoins or project tokens)

- Potential rewards up to 20% per month during high participation periods

When you hear the name Axiome (AXM) is a decentralized finance (DeFi) coin built on its own Layer1 blockchain called Axiome Chain, the first question is usually “what makes it different?” In plain terms, AXM combines a high‑yield staking system, a built‑in token‑burn model, and cross‑chain compatibility through the Cosmos SDK. Below you’ll get the rundown on how the ecosystem works, what the numbers look like, and where you can actually buy the token.

Key Takeaways

- AXM can earn up to 20%permonth through delegation rewards that also share network fees.

- Tokenomics rely on a floating reward rate and regular burns to curb inflation.

- The blockchain runs on the Cosmos SDK and uses IBC for cross‑chain swaps.

- Current circulating supply is ~6.06million of a 1billion‑token max.

- MEXC is the most active exchange for AXM/USDT trading pairs.

What Is Axiome (AXM)?

AXM token is the native utility coin that powers the Axiome DeFi ecosystem. Holders can delegate their tokens to validators, earn newly minted AXM, and receive a slice of the platform’s fees in stablecoins or other project tokens. The protocol’s mission is simple: create a scalable suite of DeFi tools that continuously boost staking rewards for its community.

Technical Backbone - Axiome Chain

The backbone of the whole system is Axiome Chain a proprietary Layer1 built with the Cosmos SDK framework. By leveraging the Cosmos SDK, the chain inherits proven scalability (thousands of transactions per second) and the Inter‑Blockchain Communication (IBC protocol a standard that lets assets move between independent blockchains) for seamless interaction with other DeFi ecosystems. This means AXM can be transferred to Cosmos‑based parachains, Polkadot hubs, or even Ethereum via bridge solutions without sacrificing speed or security.

Tokenomics - Why the Supply Doesn’t Run Away

AXM’s tokenomics revolve around two core mechanisms: a floating reward rate for delegators and a series of burning events. The floating rate adjusts based on network participation, keeping inflation in check while still offering attractive yields. Meanwhile, each time a validator claims rewards, a percentage of the minted tokens is automatically burned. The result? A maximum supply capped at 1billion, with only about 6million circulating today, giving the protocol room to release new tokens responsibly as the ecosystem expands.

Delegation Rewards - How Up to 20% Can Be Earned

The most eye‑catching feature is the delegation rewards a staking model that lets AXM holders earn newly minted tokens and a share of network fees. By delegating to trusted validators, users receive a variable APY that can reach 20% per month during high‑participation periods. Rewards are paid out in AXM and, depending on the project, in stablecoins like USDC or the native token of an integrated DeFi app. This dual‑income approach encourages long‑term holding and helps stabilize the token’s price.

Market Snapshot - Price, Volume & Where to Trade

As of 3October2025, AXM trades around $0.020 on Binance, showing a 17.9% rise in the last 24hours. The 24‑hour volume varies by source-Binance reports roughly $170, while CoinCodex cites $129,500. The fully‑diluted market cap sits near $17million, but the current market cap is just over $103k, reflecting its early‑stage status. The token’s all‑time high hit $0.518, underscoring the volatility typical of small‑cap crypto assets.

The most active trading venue is MEXC exchange a centralized crypto exchange with the highest AXM/USDT volume. The AXM/USDT pair alone moved about $85,800 in the past day, making MEXC the go‑to platform for liquidity seekers.

How to Buy and Stake AXM

- Create an account on a supported exchange-MEXC is recommended for its depth.

- Complete KYC (if required) and deposit a stablecoin such as USDT.

- Locate the AXM/USDT market and place a market or limit order.

- Transfer the purchased AXM to a supported wallet (e.g., Keplr) that can interact with Axiome Chain.

- In the wallet’s staking interface, choose a validator and delegate the amount you wish to lock.

- Monitor rewards weekly; you can re‑delegate or claim earnings as desired.

Risks, Regulations & Community Factors

Like any crypto, AXM is subject to market volatility, regulatory shifts, and project‑specific risks. Sudden changes in government tax policy or crypto‑friendly legislation can swing the price dramatically. Social media hype-especially from influencers-has historically moved AXM up or down within hours. The community runs an active Discord and Twitter presence; staying plugged into those channels is essential for catching announcements about new integrations or burning events.

Why Axiome Could Matter in the DeFi Landscape

The combination of high staking yields, a burn‑based supply model, and cross‑chain abilities positions Axiome as a potential growth engine for smaller DeFi projects seeking liquidity. By rewarding AXM stakers with revenue shares from integrated apps, the ecosystem creates a virtuous loop: more projects → more revenue → higher staking rewards → more AXM demand.

Frequently Asked Questions

What is the maximum supply of AXM?

AXM is capped at 1billion tokens. Only about 6million are circulating today.

How are delegation rewards calculated?

Rewards use a floating APY that adjusts to network participation and validator performance. When the network is healthy, yields can reach up to 20% per month, paid in AXM plus a share of fees in stablecoins or project tokens.

Which exchanges list AXM?

The most liquid market is on MEXC. AXM also appears on Binance (limited pairs) and a few smaller CEXs.

Can I use AXM outside the Axiome ecosystem?

Thanks to IBC, AXM can be bridged to other Cosmos‑based chains, allowing it to be used in external DeFi apps that support the protocol.

What are the main risks of holding AXM?

Price volatility, regulatory changes, and the dependency on validator performance are the top risks. Investors should only allocate what they can afford to lose.

Bottom Line

If you’re hunting for a DeFi token that offers real staking yields, a burn‑controlled supply, and cross‑chain play‑ground access, Axiome (AXM) checks most of those boxes. The market is still tiny-under $110k in market cap-but the upside could be significant if the ecosystem attracts more projects and the reward model stays attractive. As always, do your own research, watch the community channels, and only invest what you’re comfortable risking.

Ron Hunsberger

May 26, 2025 AT 22:28AXM's staking rewards are tied to network participation, so keep an eye on validator uptime. The token burn mechanism helps control inflation over time. Delegating even a modest amount can still yield decent APY during active periods. Be sure to use a wallet that supports Cosmos IBC for seamless transfers.

Henry Mitchell IV

May 30, 2025 AT 17:01Nice read! 😊

bhavin thakkar

June 3, 2025 AT 11:34AXM bursts onto the scene like a comet blazing across the DeFi sky, promising astronomic yields that make seasoned investors sit up straight. Its Layer‑1 foundation, built on the Cosmos SDK, grants it the scalability and interoperability that many newer chains lack. In the world of staking, the protocol offers a floating APY that can swell to a staggering twenty percent per month when the network is humming with activity. This isn’t a static promise; the reward rate breathes with validator performance and overall network health, creating a dynamic ecosystem. The token‑burn model silently trims the circulating supply each time rewards are claimed, acting as a counterweight to inflation. With only about six million AXM in circulation against a one‑billion cap, the scarcity factor can become a powerful driver of price, especially if adoption accelerates. Cross‑chain compatibility via IBC means that AXM can hop onto other Cosmos‑based chains, Polkadot hubs, and even Ethereum via bridges, expanding its utility far beyond a single silo. The staking mechanism not only mints new tokens but also distributes a cut of network fees, sometimes in stablecoins, giving delegators a dual‑revenue stream. Such a structure incentivizes long‑term holding, as the more you stake, the larger your slice of both newly minted and fee‑derived income. However, the allure of high yields does not come without risk; validator misbehaviour or network congestion can erode expected returns. The market data as of early October 2025 shows AXM trading at roughly two cents, a modest price that belies its potential volatility. Its all‑time high of over fifty cents illustrates how swiftly sentiment can swing in the crypto arena. For newcomers, the recommended entry point is through the MEXC exchange, followed by a transfer to a Cosmos‑compatible wallet like Keplr for staking. Finally, keep an eye on community channels-Discord and Twitter-because burns and new integrations are often announced there first, and they can push the token’s economics in unexpected directions.

Marie Salcedo

June 7, 2025 AT 06:07AXM's community vibe is really welcoming, and the staking guide is pretty straightforward. If you’re just starting out, I’d suggest delegating a small amount first to get a feel for the rewards.

Narender Kumar

June 11, 2025 AT 00:39The architectural choice of the Cosmos SDK confers both modularity and inter‑chain operability, attributes essential for contemporary DeFi platforms. Consequently, AXM is positioned to leverage cross‑chain liquidity effectively.

Anurag Sinha

June 14, 2025 AT 19:12Listen, the whole ‘high‑yield’ story is a smokescreen. They’re pumping APY numbers while the real game is hidden in the burn contracts. Every time a validator claims, a secret portion is siphoned off to undisclosed wallets. The IBC bridges? Just a backdoor for moving tokens off‑chain without oversight. Stay vigilant, or you’ll be left holding dust.

Andrew McDonald

June 18, 2025 AT 13:45Only seasoned analysts can see through the hype; the rest are just chasing glittering APRs. 🙄

karyn brown

June 22, 2025 AT 08:18Wow, such deep insight! 😂🔥

Michael Ross

June 26, 2025 AT 02:50AXM's price movements reflect typical small‑cap volatility, nothing out of the ordinary.

Deepak Chauhan

June 29, 2025 AT 21:23In the grand tapestry of blockchain sovereignty, AXM stands as a beacon for our nation's digital future. Its cross‑chain design aligns with the vision of technological independence.

Aman Wasade

July 3, 2025 AT 15:56Oh great, another token promising 20% a month-just what the world needed.

Lana Idalia

July 7, 2025 AT 10:29I can literally feel the panic whenever AXM dips below a cent; it's like a rollercoaster that never stops. The community's hype circles around me like a storm, draining any calm I try to keep. Yet, I can't help but watch the charts obsessively, hoping for that next surge. It's exhausting but oddly addictive.

Mangal Chauhan

July 11, 2025 AT 05:01If you're new to staking, start with a wallet you trust, such as Keplr, then delegate a manageable amount-maybe 500 AXM-to a reputable validator. 🎯 Monitor the rewards weekly; you can always adjust your delegation as you learn. 🌱 Remember, diversification across validators can reduce risk.

Darius Needham

July 14, 2025 AT 23:34The IBC integration truly expands AXM's utility, letting it interact with a growing ecosystem of DeFi protocols.

carol williams

July 18, 2025 AT 18:07While the tokenomics appear sound, prospective investors should conduct thorough due diligence on validator performance metrics before committing significant capital.

Maggie Ruland

July 22, 2025 AT 12:39Sure, because 20% monthly returns never lead to bubbles.

Raj Dixit

July 26, 2025 AT 07:12Inflation is mitigated by regular burns.

Darrin Budzak

July 30, 2025 AT 01:45I’m just watching the charts and sipping coffee, no rush to jump in.

Latoya Jackman

August 2, 2025 AT 20:18AXM's current market cap sits just above $100,000, reflecting its early‑stage status.

karsten wall

August 6, 2025 AT 14:50From a protocol‑layer perspective, AXM leverages Tendermint consensus to achieve BFT finality, enabling sub‑second transaction confirmations within its heterogeneous IBC‑enabled environment.

Keith Cotterill

August 10, 2025 AT 09:23Wow!!! AXM!! Is it a real thing??!!? Let’s see…

C Brown

August 14, 2025 AT 03:56Oh, the glorious promise of 20% per month-because who needs reality when you have fantasy finance!

CJ Williams

August 17, 2025 AT 22:28Keep learning, stay curious, and remember: every great journey starts with a single delegation! 🚀💪