How to Prevent 51% Attacks on Blockchains: Real-World Strategies for Network Security

51% Attack Cost Calculator

This calculator estimates the cost to mount a 51% attack on various blockchains. It uses real-world data from the article to show how economic factors make some networks vulnerable while others remain secure.

Note: These calculations are based on current market conditions and may change. A successful attack could cause market crashes, so the actual cost may be higher than calculated.

What a 51% attack really does to a blockchain

Imagine you wake up one morning and find out someone erased your last five Bitcoin transactions-your payment to a vendor, your deposit to an exchange, even your last withdrawal. All gone. Not because you made a mistake. Not because of a hack. But because someone else controlled the network long enough to rewrite history. That’s a 51% attack.

It doesn’t require supercomputers or magic. It just needs more computing power than everyone else combined. In proof-of-work blockchains like Bitcoin, that means controlling over half of the total mining hash rate. In proof-of-stake chains like Ethereum, it means owning more than half of all staked tokens. Once that threshold is crossed, the attacker can block new transactions, reverse confirmed payments, and double-spend coins. The blockchain doesn’t break. It just becomes untrustworthy.

And it’s happened. More than 40 times since 2019. Not on Bitcoin. Not on Ethereum. But on smaller coins: Bitcoin Gold, Verge, Litecoin Cash. In 2020, Verge lost $1.7 million in a single attack. In 2022, Ethereum Classic had 3,631 blocks reversed, freezing deposits on Binance for three days. These aren’t theoretical risks. They’re real losses, happening right now to coins nobody’s watching.

Why small blockchains are easy targets

The bigger the network, the harder it is to attack. Bitcoin’s network requires about 400 exahashes per second (EH/s) to control. That’s roughly $12.7 billion in mining hardware and $48 million in daily electricity. No individual or even a nation-state can afford that-unless they’re willing to lose more than they steal.

But look at a coin with a $20 million market cap and only 0.6 EH/s of hash power. Renting enough computing power to take it over costs less than $1,500 on NiceHash for a few hours. That’s cheaper than a used car. And that’s exactly what attackers do. They rent, attack, cash out, and disappear. The network recovers. The coin’s price drops. Users lose money. And the attacker walks away clean.

Chainalysis found that 87% of all 51% attacks target blockchains with market caps under $50 million. Why? Because the cost to break them is lower than the reward. It’s not a flaw in cryptography. It’s a flaw in economics. If the value of the asset doesn’t justify the cost to defend it, someone will try to break it.

How Proof-of-Work networks fight back

Bitcoin doesn’t just rely on size. It has built-in defenses. Since 2016, Bitcoin Core developers have monitored mining pools. If any single pool hits 40% of the total hash rate, alerts go out. The community reacts. Miners move. Pools split. The network self-corrects.

Some newer PoW chains use extra layers. The MIT-developed ChainLocks protocol, for example, requires 60% of miners to sign each block. Even if you control 51% of the hash rate, you still need 60% of the signers. That’s nearly impossible without controlling the mining hardware itself-and even then, it’s risky. If you’re caught, your hardware gets blacklisted. Your investment vanishes.

Another trick? Block time monitoring. MIT’s Blockchain Security Monitor watches for sudden spikes in block creation speed. If blocks start appearing every 20 seconds instead of 10 minutes, it’s a red flag. The system flags it, exchanges freeze deposits, and users get warned. In 2023, one Ravencoin miner triggered a false alarm after accidentally overclocking their rigs. The network paused for 47 minutes while they checked it. Not perfect. But it stopped a potential attack before it started.

How Proof-of-Stake networks stop attacks before they start

After Ethereum switched to proof-of-stake in September 2022, 51% attacks became a lot harder. Why? Because you don’t rent hardware-you buy tokens. To control 51% of Ethereum, you’d need to buy over 17 million ETH. At $3,200 per ETH, that’s $54 billion. You’d crash the market before you even started.

But it gets better. Ethereum uses slashing. If a validator tries to cheat-like signing two conflicting blocks-they lose part of their stake. The more they cheat, the more they lose. In late 2022, a group tried to control 35% of Ethereum’s validators. They didn’t even get close to 51%. But the slashing mechanism still punished them for misbehavior. They lost millions. The network kept running.

Cardano and Solana use similar rules. Validators must lock up large amounts of native tokens. And if they act maliciously, those tokens are destroyed. It’s not just expensive to attack. It’s financially suicidal.

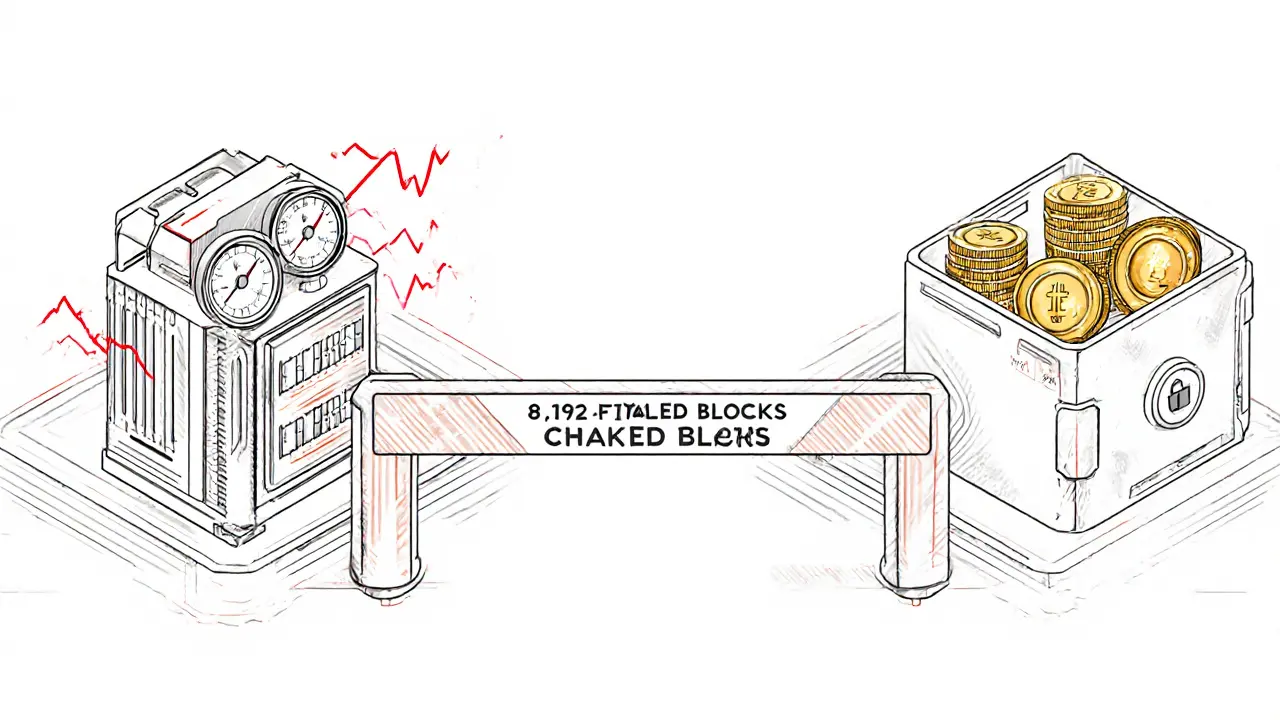

There’s one catch: long-range attacks. If someone holds 66% of staked tokens for over two weeks, they could theoretically rewrite the entire chain from the beginning. That’s why most PoS chains use checkpointing. Ethereum, for example, freezes the last 8,192 blocks as unchangeable. Even if you control 90% of the stake, you can’t touch those blocks. History becomes permanent.

Hybrid models and enterprise blockchains

Some blockchains mix both worlds. Decred uses 60% proof-of-work and 40% proof-of-stake. In a 2021 test, researchers tried to control 65% of the network. They failed. Why? Because you’d need to control both the miners and the stakers. Two separate systems. Two separate costs. It’s like trying to break into a bank by stealing the keys and the vault code.

Enterprise blockchains like Hyperledger Fabric don’t even use mining or staking. They use Practical Byzantine Fault Tolerance (PBFT). In PBFT, a network of trusted nodes vote on each block. As long as two-thirds of the nodes are honest, the system works. Even if 33% are compromised, the network keeps going. That’s why 72% of Fortune 500 companies use permissioned blockchains-they don’t need decentralization. They need reliability.

And they’re right to. Gartner’s 2023 security rating gave Hyperledger Fabric a 92/100. Bitcoin? 78/100. Not because Bitcoin is weak. But because public blockchains are open to anyone. And that openness is a double-edged sword.

What you can do as a user or developer

If you’re a user: avoid small, low-market-cap coins. If a coin’s price is under $50 million, assume it’s vulnerable. Don’t store large amounts on exchanges that support those coins. Wait for at least 10 confirmations before considering a transaction final. On Bitcoin, that’s about 100 minutes. On Ethereum, it’s 15 seconds. But on a small PoW chain? Wait 24 hours. Better safe than sorry.

If you’re a developer building a new blockchain: don’t launch with fewer than 1,000 mining nodes (for PoW) or 1,024 validators (for PoS). Distribute them across at least six continents. Use economic penalties. Use checkpointing. Use community voting. Don’t rely on size alone. Size helps, but structure matters more.

And if you’re running a mining pool or stake pool: never let your share go above 30%. If you hit 40%, voluntarily reduce your capacity. The community will thank you. And you’ll avoid becoming the target.

The future of 51% attack prevention

Things are getting better. Ethereum’s Dencun upgrade, coming in early 2024, will separate block proposers from block builders. That means no single entity can control both the order of transactions and their inclusion. It closes a hidden centralization risk that could lead to 51% vulnerabilities.

MIT’s new AI-powered monitor, released in October 2023, can predict attacks before they happen. It looks at hash rate trends, mining pool behavior, and even rental market data. In testing, it flagged 89% of attacks before they occurred. That’s huge.

Regulators are catching up too. The EU’s MiCA law, effective June 2024, forces all crypto services to prove they can detect and prevent majority attacks. No more excuses. No more ignoring the risk.

By 2027, experts predict attacks on networks with market caps over $1 billion will drop to under 0.5 per year. Right now, it’s 2.3. Progress isn’t perfect. But it’s real.

Bottom line: Security is a team sport

No single fix stops a 51% attack. It’s not about one algorithm. It’s about economics, community, infrastructure, and timing. A blockchain is only as secure as its least trusted participant. That’s why decentralization isn’t just a buzzword-it’s the only thing that keeps the system alive.

Big networks are safe because they’re expensive to attack. Small ones aren’t. Users need to know the difference. Developers need to build with defense in mind. And the whole ecosystem needs to act like a team-not a collection of isolated projects.

Because when a blockchain loses trust, it loses everything.

Can a 51% attack happen on Bitcoin?

Technically, yes. But practically, no. Bitcoin’s network requires over $12 billion in hardware and $48 million in daily electricity to control. No entity has that kind of capital, and even if they did, the cost of the attack would far exceed any possible gain. Plus, the community would quickly respond-miners would leave, exchanges would halt trading, and the network would fork to invalidate the attacker’s blocks. Bitcoin’s size is its strongest defense.

Is proof-of-stake completely immune to 51% attacks?

No. While PoS makes attacks much harder, it’s not impossible. To control 51% of Ethereum, you’d need to buy over $50 billion worth of ETH. That would crash the price before you finished buying. But if you already owned that much, you’d be losing more than you’d gain. Slashing penalties make it even riskier. Still, long-range attacks-where an attacker controls >66% of staked tokens for weeks-are a theoretical concern. That’s why checkpoints and finality layers exist.

Why do most 51% attacks target small cryptocurrencies?

Because they’re cheap to attack. A coin with a $20 million market cap and low hash rate can be rented for under $1,500 for a few hours. The attacker double-spends, cashes out, and disappears. The cost to defend is higher than the value of the coin itself. It’s not a bug-it’s a market failure. Small coins lack the economic incentives to secure themselves properly.

Can exchanges prevent 51% attacks?

Not directly, but they can reduce damage. Exchanges like Binance and Coinbase monitor blockchain reorganizations. If a chain reorg exceeds 10 blocks, they freeze deposits and withdrawals. They also delay finality for small-cap coins-requiring 50+ confirmations instead of 6. This gives the network time to recover and users time to react. They’re the last line of defense for everyday users.

What’s the best way to protect my crypto from a 51% attack?

Don’t hold large amounts in small, low-market-cap coins. Stick to Bitcoin, Ethereum, and other networks with market caps over $1 billion. Wait for at least 10 confirmations on Bitcoin, and 15+ on smaller PoW chains. Use exchanges that have clear reorg policies. And never trust a transaction as final until the network has had time to confirm it-usually 10 minutes to 24 hours, depending on the coin.

vinay kumar

November 19, 2025 AT 18:41Small chains are just gambling tokens with blockchain branding

Roshan Varghese

November 19, 2025 AT 20:43they're all rigged anyway

the big boys own the miners and the exchanges and the regulators

you think verge got hacked? nah bro

they just shut it down to kill the competition

same with btc

they let it look decentralized but the top 10 pools control everything

and you wanna know what's wild

the same people who run the mining pools also run the crypto hedge funds

they profit when it crashes

they profit when it pumps

they profit when you panic sell

they profit when you hodl too long

they profit when you get reorged

they profit when you don't even know what a reorg is

it's not a 51% attack

it's a 100% scam

Abhishek Anand

November 20, 2025 AT 07:41What’s being missed here is the fundamental misalignment between economic incentives and security architecture

Blockchains aren’t secure because they’re cryptographically sound-they’re secure because the cost of attack exceeds the expected return

That’s not a feature. That’s a temporary equilibrium

Once tokenomics shift-whether through volatility, dilution, or speculative collapse-the attack surface reopens

Proof-of-work doesn’t solve this

It just externalizes the cost onto electricity grids and hardware manufacturers

Proof-of-stake doesn’t solve this either

It just shifts the cost to capital concentration and whale dominance

Neither model addresses the core problem: decentralization is not a technical condition

It’s a social contract

And social contracts collapse when trust erodes

Checkpointing? That’s just centralized governance in disguise

Community monitoring? That’s reactive, not preventive

What we need is a mechanism that makes selfish behavior economically irrational at the individual validator level

Not just punitive

But structurally disincentivized

Like a zero-sum penalty system tied to real-world identity

Or a reputation layer baked into the protocol

Until then

We’re just rearranging deck chairs on the Titanic

And calling it innovation

Leisa Mason

November 21, 2025 AT 12:49Let’s be honest

Most of these so-called security measures are just marketing

Checkpoints? Slashing? ChainLocks?

They’re all just band-aids on a bullet wound

Bitcoin’s 51% attack resistance isn’t because it’s secure

It’s because nobody has $12 billion to waste on a publicity stunt

And even then

If someone did

They’d just fork the chain and claim the original was compromised

And the community would split

And then we’d have two coins

And the attacker would still win

Because they’d own both

And the real victims? The people who didn’t know enough to get out

That’s not security

That’s gambling with a fancy name

Rob Sutherland

November 22, 2025 AT 16:01I’ve been thinking about this a lot

What if the real problem isn’t the attack

But our expectation that blockchains should be immutable

Maybe we’re asking the wrong question

Instead of how to prevent 51% attacks

Shouldn’t we be asking

Why do we need absolute immutability in the first place

Human systems aren’t immutable

Legal systems correct mistakes

Financial systems reverse fraud

Even history gets rewritten

What if we designed blockchains to be self-correcting

Not by force

But by consensus

Like a living organism

That adapts

Not by resisting change

But by integrating it

Maybe the goal shouldn’t be to stop attacks

But to make them harmless

By building in recovery mechanisms

That are transparent

And democratic

And slow

Not perfect

But human

Melina Lane

November 23, 2025 AT 10:25Thank you for writing this

So many people think crypto is magic

But you showed the real math behind it

And the real risks

Small coins are like buying a car with no brakes

It looks cool

But you’re not supposed to drive it on the highway

And if you do

Don’t blame the road

Blame yourself for not checking the specs

Keep sharing this kind of clarity

We need more of it

andrew casey

November 24, 2025 AT 21:05It is worth noting that the current paradigm of blockchain security is predicated upon a neoliberal economic model that assumes rational actors with infinite capital

This assumption is not only empirically false

But also epistemologically dangerous

When we conflate market capitalization with security

We are not securing networks

We are commodifying trust

And in doing so

We are replicating the very structural inequalities we claim to dismantle

The notion that a $50 million market cap is inherently insecure

While a $50 billion market cap is secure

Is not a technical assertion

It is a value judgment

One that privileges capital concentration over participatory sovereignty

And in this light

Even Ethereum’s slashing mechanism

Is merely a mechanism of class discipline

For those who cannot afford to stake

Are not merely vulnerable

They are excluded

And exclusion is not security

It is control

Lani Manalansan

November 25, 2025 AT 23:51I’m from the Philippines

We’ve had crypto scams here since 2017

People invest their life savings in coins with no whitepaper

No team

No code

Just a Telegram group and a promise

And when it crashes

They blame the blockchain

But it’s not the blockchain

It’s the lack of financial literacy

And the absence of regulation

Security isn’t just about hash rates

It’s about education

It’s about access

It’s about giving people tools

Not just technology

So when I read this post

I didn’t just see a technical breakdown

I saw a call to action

For developers

For educators

For regulators

For all of us

Don’t just build better chains

Build better understanding

Frank Verhelst

November 26, 2025 AT 12:30🔥🔥🔥 YES

Stop trusting small coins

Wait for 10 confirmations

Use exchanges with reorg policies

And if you’re a dev

Don’t launch with 200 validators

That’s not decentralization

That’s a party

Build real nodes

Across continents

And don’t be lazy

Security isn’t optional

It’s the price of entry

Dexter Guarujá

November 26, 2025 AT 13:56Let’s cut the crap

The U.S. and China control 70% of Bitcoin mining

So who’s really running this

And now you want me to believe Ethereum is secure because it has slashing

Slashing? That’s just a fancy word for confiscation

And you think a government won’t just force validators to comply

With a subpoena and a threat

There’s no such thing as decentralization anymore

It’s all controlled by state-backed entities

And you’re just giving them more tools

With your fancy checkpoints

And AI monitors

They’ll use it to track you

To freeze you

To censor you

This isn’t security

This is surveillance with a blockchain logo

Natalie Reichstein

November 26, 2025 AT 21:06It’s funny how people act like 51% attacks are some new threat

They’ve been happening since 2014

And yet

No one learns

Every time a new coin launches

Everyone says

‘This one’s different’

Then it gets hacked

Then the devs disappear

Then the price drops 95%

Then someone writes a blog post like this

And everyone says

‘Wow this is so insightful’

And then they go back to buying the next low-cap coin

Because they’re not here to learn

They’re here to gamble

And that’s fine

But don’t pretend you’re building the future

You’re just betting on it

Kaitlyn Boone

November 28, 2025 AT 11:05the whole thing is a scam

no one cares about security

they care about getting rich quick

the devs are just selling snake oil

and the users are the ones who end up paying

again and again

and no one talks about how the exchanges profit from it

they list every coin

even the ones that get hacked

because they take fees

on every trade

on every deposit

on every withdrawal

they don’t want security

they want volume

James Edwin

November 30, 2025 AT 08:23I’ve been running a mining node for 3 years

I’ve seen pools go from 5% to 42%

And then collapse

When the community notices

Miners start moving

Not because they’re ethical

But because they’re smart

They know if a pool hits 40%

The network will fork

And their hardware will be worthless

So they self-regulate

It’s not perfect

But it’s organic

And it works

That’s the beauty of it

No one’s in charge

But everyone’s watching

That’s decentralization

Not code

Not algorithms

But awareness

Khalil Nooh

December 1, 2025 AT 19:41Let’s not romanticize proof-of-stake

It doesn’t prevent 51% attacks

It just makes them more expensive

And more politically dangerous

If you own 51% of Ethereum’s ETH

You’re not just a validator

You’re a systemic risk

The entire financial ecosystem is now tied to your behavior

So the SEC will come knocking

The Treasury will demand audits

The Fed will monitor your wallet

And you’ll lose your anonymity

So the real barrier isn’t capital

It’s exposure

That’s why 51% attacks on PoS are rare

Not because they’re impossible

But because the attacker becomes the target

And that’s not security

That’s social pressure

Chris G

December 1, 2025 AT 21:18Bitcoin is secure because it’s too big to fail

Not because it’s designed well

It’s just a legacy system

With too much inertia

And too many people invested

That’s not security

That’s inertia

And if Bitcoin ever lost its dominance

It would collapse faster than any altcoin

Because its entire security model is based on popularity

Not architecture

Phil Taylor

December 3, 2025 AT 15:50British miners have been quietly dominating Bitcoin since 2021

Most people don’t realize it

But the UK has the most efficient cooling systems

And the lowest electricity costs in Europe

And the most stable regulatory environment

So who’s really controlling the hash rate

Not China

Not the U.S.

It’s the City of London

And they’re not even talking about it

Because they don’t need to

They just sit there

Collecting fees

And watching the world burn

Meanwhile

You’re worried about Verge

diljit singh

December 5, 2025 AT 01:17small coins are trash

no one cares about them

why even talk about it

just stick to btc and eth

and stop giving attention to these scam coins

they deserve to die

LaTanya Orr

December 6, 2025 AT 19:40What I love about this post

Is how it doesn’t just list solutions

But shows the human layer behind them

Miners moving pools

Exchanges freezing deposits

Developers voluntarily reducing capacity

These aren’t protocols

They’re choices

And choices made by people

Not machines

That’s the real power

Not the code

But the community

That’s what keeps it alive

When the math fails

The people step in

And that’s beautiful

Ashley Finlert

December 7, 2025 AT 14:06There is a poetic symmetry in this

That the very openness which makes blockchain revolutionary

Also makes it vulnerable

Like a democracy

It thrives on participation

But suffers from exploitation

And yet

We do not abandon democracy

Because it can be manipulated

We strengthen it

With transparency

With education

With civic responsibility

So why do we treat blockchain differently

Is it because we see it as technology

And not society

But it is both

And perhaps

The greatest innovation

Is not in the algorithm

But in our willingness

To treat it as a shared civilization

Chris Popovec

December 9, 2025 AT 07:38the AI monitor is just a honeypot

they’re tracking who’s renting hash

and flagging it

so the exchanges can ban those wallets

and the miners get blacklisted

but who’s running the AI

who owns the data

is it decentralized

or is it just another corporate surveillance tool

with a blockchain sticker on it

and you’re calling that progress

lol

we’re not building freedom

we’re building better prisons

Marilyn Manriquez

December 10, 2025 AT 09:56This is one of the clearest, most thoughtful pieces I’ve read on blockchain security

It doesn’t just explain the mechanics

It explains the moral weight

That every coin carries

Every validator

Every miner

Every user

Is part of a social contract

And when we ignore that

We don’t just risk attacks

We risk losing the soul of what we’re trying to build

Thank you

For reminding us

That technology without ethics

Is just a tool for exploitation

taliyah trice

December 12, 2025 AT 03:01if you’re new to crypto

just stick to bitcoin

and wait for 10 confirmations

and don’t touch anything under 1 billion

that’s it

you’re safe

Charan Kumar

December 14, 2025 AT 00:00in india we have so many crypto scams

people buy coins from telegram groups

no one checks the code

no one checks the team

they just see a 10x promise

and jump in

and when it crashes

they blame the blockchain

but it’s not the blockchain

it’s the greed

and the lack of education

we need to teach this in schools

not just tech

but responsibility

Peter Mendola

December 14, 2025 AT 02:3951% attacks are irrelevant

the real threat is regulatory capture

and centralized exchanges

when the SEC forces a chain to freeze funds

or a bank shuts down a wallet

no algorithm can stop that

and no hash rate can protect you

your money is only as safe as the legal system you’re in

blockchain doesn’t change that

it just makes it prettier

Tim Lynch

December 15, 2025 AT 00:54There’s something haunting about the idea that the most secure network in the world

Is also the most energy-intensive

And the most centralized in practice

Because the only reason Bitcoin is safe

Is because it’s too expensive to attack

But what happens when the next Bitcoin emerges

And it’s built on solar power

And distributed mining

And zero-knowledge proofs

And it’s cheap to attack

But still secure

Because it’s designed differently

Not just bigger

But smarter

What if the future of security

Isn’t in scale

But in elegance

And we’re clinging to a dinosaur

Just because it’s loud

And old

And familiar

Jennifer Corley

December 15, 2025 AT 14:06It’s not that small chains are vulnerable

It’s that we’ve normalized their vulnerability

We treat them like beta software

And that’s the real crime

Because the people who invest in them

Are not speculators

They’re believers

They think they’re building something new

Instead of being the lab rats

For the next big exploit

And we let them

We write blog posts like this

And pat ourselves on the back

For being so insightful

But we don’t stop listing them

We don’t stop promoting them

We don’t stop profiting from them

So who’s really responsible

Not the attacker

Not the dev

But the entire ecosystem

That looks away

Kris Young

December 16, 2025 AT 17:43the author is right

but what about the miners

they’re the ones who actually keep it running

and they get nothing

no recognition

no rewards

just electricity bills

and the community acts like they’re invisible

until the network gets hacked

then everyone wants to know

who’s mining where

and how to fix it

but no one asks

how are they living

how are they paid

how do they sleep at night

knowing their rigs are the only thing keeping a $100 million coin alive

that’s the real 51% attack

on the people who make it possible

jack leon

December 16, 2025 AT 19:39What’s missing from this entire discussion is the human factor

Every blockchain is only as strong as its weakest participant

Not the miner

Not the validator

But the user

The one who clicks ‘confirm’ without checking

The one who stores keys on a phone

The one who trusts an exchange

The one who doesn’t wait for confirmations

The one who buys a coin because it’s trending

That’s the real attack surface

And it’s not fixable with code

It’s fixable with education

And patience

And humility

Because the greatest threat to blockchain

Is not a hacker

It’s ignorance

Laura Lauwereins

December 16, 2025 AT 22:15you’re all missing the point

the real 51% attack is happening right now

and it’s not on the blockchain

it’s on your brain

they’re feeding you fear

and solutions

so you’ll keep trading

keep investing

keep believing

that there’s a technical fix

when the real fix is to stop playing

and walk away

the game is rigged

and you’re the house

andrew casey

December 18, 2025 AT 10:08Thank you for this

It’s rare to see someone articulate the tension between decentralization and economic feasibility

Without resorting to slogans

Or fearmongering

Or crypto bro jargon

This is what thoughtful discourse looks like

And I hope it’s not the last

Rob Sutherland

December 18, 2025 AT 18:21You’re right

And that’s why I think the real innovation

Will come from communities

Not protocols

When users start demanding

Transparency

Accountability

And fairness

Not just higher APY

That’s when the system changes

Not before