Post-Quantum Cryptography for Cryptocurrency: What You Need to Know Now

Right now, billions of dollars in cryptocurrency are sitting in wallets that could be stolen by a computer that doesn’t even exist yet. It sounds like science fiction, but it’s not. The same math that protects your Bitcoin and Ethereum - Elliptic Curve Digital Signature Algorithm, or ECDSA - is vulnerable to future quantum computers. And if someone cracks it, they could sign transactions as you, drain your wallet, and no one could stop them. This isn’t a distant fear. Experts say there’s a 50% chance it happens by 2031. The fix? Post-quantum cryptography - and it’s already being tested, debated, and quietly built into the next generation of blockchain systems.

Why Your Crypto Wallet Is at Risk

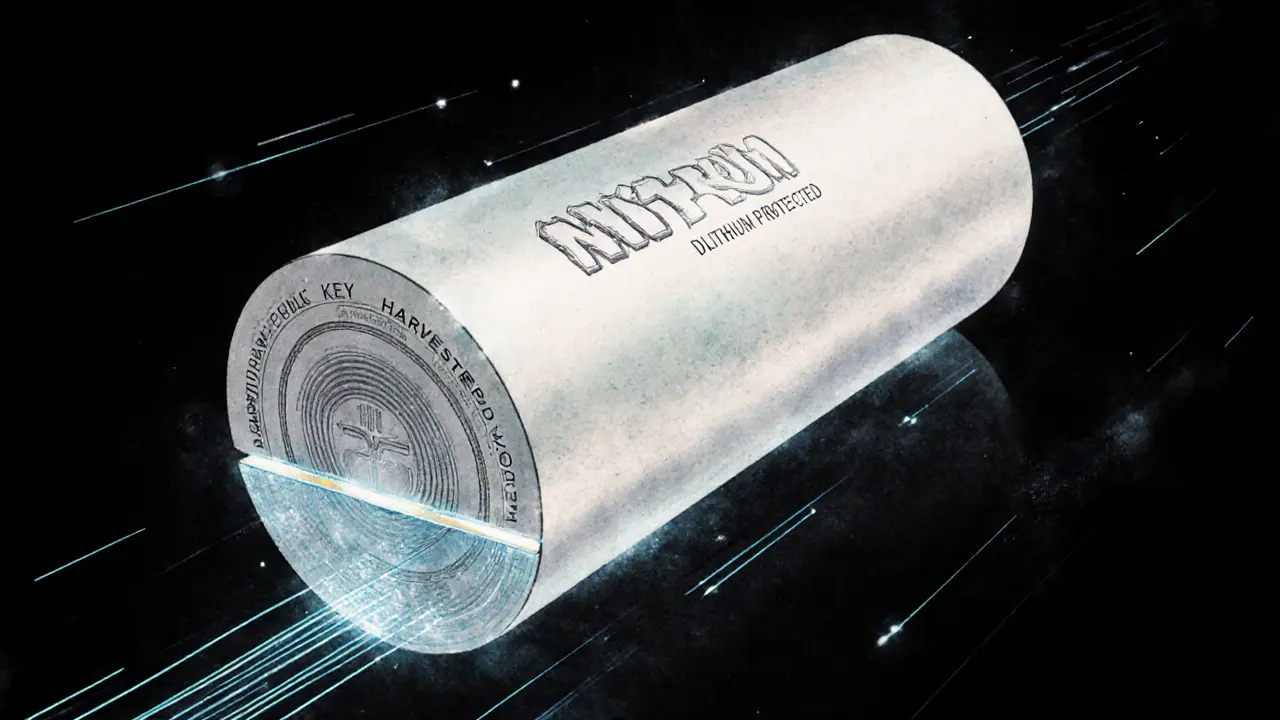

Every time you send Bitcoin or Ethereum, you sign the transaction with a private key. That signature is verified using ECDSA, a system that’s been trusted since Bitcoin’s birth in 2009. It’s fast, compact, and efficient - perfect for a blockchain that needs to process thousands of transactions per second. But ECDSA relies on a mathematical problem that’s hard for regular computers to solve… but not for quantum ones. A quantum computer running Shor’s algorithm could crack ECDSA in minutes, not billions of years. That means anyone who collects your public key today - which is visible on every blockchain - could wait until quantum computers are powerful enough, then decrypt your private key and steal your coins. This is called a “harvest now, decrypt later” attack. And according to Chainalysis, around 4 million BTC - worth over $114 billion as of late 2023 - are sitting in addresses where the public key is exposed. That’s not a small number. That’s the entire market cap of dozens of major companies.What Is Post-Quantum Cryptography?

Post-quantum cryptography (PQC) is a set of new mathematical algorithms designed to resist attacks from both classical and quantum computers. Unlike ECDSA, these algorithms don’t rely on factoring large numbers or solving elliptic curve problems. Instead, they use entirely different math - like lattices, hash functions, or multivariate polynomials - that even quantum computers struggle with. In 2022 and 2023, NIST - the U.S. government agency that sets cryptographic standards - finalized two PQC algorithms as the global baseline: Crystals-DILITHIUM for digital signatures and Crystals-KYBER for key exchange. These are now the gold standard. They’ve been tested by cryptographers worldwide for years. No major flaws have been found. And they’re the only ones with enough confidence to be considered for real-world use.The Big Problem: Size and Speed

Here’s where things get messy. PQC isn’t just a drop-in replacement. It’s bulky. - A Bitcoin ECDSA signature is 72 bytes. - A Crystals-DILITHIUM signature is 2,420 bytes - over 33 times larger. That means one block on Bitcoin’s network, which currently holds around 3,000 transactions, would only fit 120 DILITHIUM signatures. That’s a 96% drop in throughput. Ethereum’s average transaction fee of $1.50 could jump to $50 or more without major upgrades. Even the smallest wallets would see higher fees just to move coins. Hash-based schemes like SPHINCS+, used by Quantum Resistant Ledger, are even worse - signatures can be 8,000 bytes. That’s fine for storing long-term value, but terrible for everyday payments. Performance isn’t much better. Signing a transaction with ECDSA takes 0.03 milliseconds. With DILITHIUM, it’s 1 millisecond. That might sound tiny, but when you’re processing millions of transactions, it adds up. Nodes would need faster hardware. Miners would need more bandwidth. The whole system slows down.

Who’s Already Doing It?

Most major blockchains - Bitcoin, Ethereum, Solana - haven’t changed a thing. But a few projects are leading the charge. - Quantum Resistant Ledger (QRL) launched in 2018. It uses hash-based signatures and has been running quantum-resistant since day one. Its market cap is around $35 million - tiny compared to Bitcoin’s $570 billion - but it proves the model works. - Ethereum has been researching PQC since 2021. They published EIP-3037 proposing a migration path. Their roadmap now lists quantum resistance as a long-term goal, with research wrapping up by 2025. But a full upgrade? That’s likely years away. It would require a hard fork - a major network change that needs near-universal agreement. Good luck getting thousands of miners, exchanges, and wallet providers to sync up. - IPFS added quantum-resistant storage options in early 2023. Not for payments, but for files. If your data is stored on a blockchain, it needs protection too. - JPMorgan Chase filed a patent in January 2023 for quantum-resistant distributed ledger tech. Banks aren’t waiting. They’re building.Hybrid Systems: The Bridge to the Future

No one’s going to rip out ECDSA overnight. The safest path is hybrid cryptography - using both old and new systems together. Imagine a transaction signed with both ECDSA and DILITHIUM. Even if a quantum computer breaks ECDSA, the DILITHIUM signature still holds. It’s like locking your door with two different keys. One might fail, but the other keeps you safe. NIST recommends this approach for transitional periods. Some wallets are already testing it. Users can move funds to hybrid addresses that support both signature types. It’s not perfect - it doubles the signature size - but it buys time. And time is exactly what we need.

What Should You Do Right Now?

You don’t need to panic. But you do need to act. 1. Move coins out of legacy addresses. If your Bitcoin is in a P2PKH address (starting with “1”), your public key is exposed every time you spend. Switch to native SegWit (bech32, starting with “bc1”). These don’t reveal your public key until you spend - meaning they’re slightly more resistant to quantum attacks. 2. Consider holding some funds in quantum-resistant chains. If you’re worried about long-term security, allocating a small portion of your portfolio to QRL or similar projects isn’t a bad hedge. They’re not as liquid, but they’re designed for the future. 3. Don’t reuse addresses. Every time you use a public key, you give attackers more data. Always generate a new address for each transaction. Most modern wallets do this automatically. 4. Stay informed. Follow Ethereum’s research updates. Watch for NIST’s upcoming publication SP 1800-39, expected in mid-2024. It’ll give clear guidance on how to implement PQC in blockchain systems.The Race Against Time

Quantum computers are advancing faster than most people realize. Google, IBM, and startups are hitting milestones every year. The machines that can break ECDSA might not be here yet - but the data to crack them is already being collected. The cryptocurrency industry has a choice: wait until it’s too late, or start building the future now. The cost of delay isn’t just technical. It’s financial. If a major quantum attack happens and $100 billion in Bitcoin vanishes overnight, trust in the entire ecosystem collapses. Prices crash. Investors flee. The whole market could reset. The solution isn’t magic. It’s math. It’s code. It’s hard work by cryptographers and developers who understand the stakes. And it’s already happening - quietly, slowly, but undeniably. The question isn’t whether post-quantum cryptography will come to cryptocurrency. It’s whether you’ll be ready when it does.Can quantum computers break Bitcoin right now?

No. Current quantum computers don’t have enough stable qubits to run Shor’s algorithm on ECDSA. The machines needed are still years away - possibly a decade or more. But the threat isn’t about today. It’s about tomorrow. Attackers are already harvesting public keys from the blockchain, storing them, and waiting for the right hardware to appear.

What’s the difference between Crystals-DILITHIUM and SPHINCS+?

Crystals-DILITHIUM is a lattice-based signature scheme. It’s faster and has smaller signatures than SPHINCS+, which is hash-based. DILITHIUM signatures are around 2,420 bytes; SPHINCS+ can be 8,000 bytes. DILITHIUM is better for high-throughput systems like payment networks. SPHINCS+ has stronger theoretical security guarantees because it relies only on hash functions - but its size makes it impractical for frequent transactions.

Will Bitcoin ever adopt post-quantum cryptography?

It’s possible, but unlikely without a hard fork. Bitcoin’s community values stability and consensus. Any major change to the signature scheme would require near-unanimous agreement from miners, developers, exchanges, and users. That’s extremely difficult. A hybrid approach - adding PQC as a new signature type alongside ECDSA - is more likely. But even that would need broad adoption before it becomes the norm.

Is Quantum Resistant Ledger (QRL) a good investment?

QRL is not a high-growth asset - its market cap is small compared to Bitcoin or Ethereum. But it’s a real-world testbed for quantum-resistant blockchain tech. If you believe quantum threats are real and want to hold crypto that’s already protected, QRL is one of the few options available. It’s not a speculative play. It’s a security play.

How long will it take for PQC to be widely adopted in crypto?

Industry experts estimate the first major hard fork implementing hybrid PQC will happen between 2026 and 2028. Full adoption could take until 2030 or later. The delay isn’t because the tech is unready - it’s because coordination across decentralized networks is slow. The sooner projects start testing and planning, the smoother the transition will be.

Louise Watson

November 9, 2025 AT 02:46Public keys on the blockchain are like leaving your house key under the mat forever.

Benjamin Jackson

November 10, 2025 AT 02:36Still, it’s wild to think we’re all just casually sitting on a ticking bomb. Maybe we need a crypto ‘Y2K’ moment.

Liam Workman

November 10, 2025 AT 11:30Meanwhile, the quantum clock is ticking and we’re debating whether to add emojis to our wallet UIs. 🤦♂️

Hybrid signatures are the obvious bridge - why is this not already mandatory? I get inertia, but this isn’t a feature request - it’s a survival tactic.

Ryan McCarthy

November 10, 2025 AT 14:51Meanwhile, 90% of wallets still use reused addresses and 30% of users don’t even know what a private key is.

We have bigger problems than quantum computers.

Abelard Rocker

November 11, 2025 AT 02:35And we’re still debating whether to add a ‘Send to QRL’ button?

Bro, we’re not just late - we’re the punchline of a joke written by a physicist who hates capitalism. The only thing more ridiculous than ECDSA is the fact that people still think Bitcoin is ‘digital gold’ when its foundation is literally a 14-year-old algorithm.

Meanwhile, QRL’s market cap is $35M and it’s the only thing that’s actually ready. I’m moving everything there. Who’s with me? 🚀

Hope Aubrey

November 12, 2025 AT 02:11We built the internet, we built Bitcoin, and we’re gonna build the quantum-resistant future too.

Stop letting open-source devs and European academics dictate our security standards. NIST is good, but we need a U.S.-first quantum crypto mandate. Now.

andrew seeby

November 12, 2025 AT 19:39didn’t even know about this quantum thing until i saw this post

thanks for the wake up call 🙏

Pranjali Dattatraya Upadhye

November 13, 2025 AT 01:31Wallets don’t update. Exchanges don’t push. Users don’t care. Even if DILITHIUM is ready, if 80% of users keep using old addresses, we’re just delaying the collapse.

Education is the real upgrade. Not code.

Leo Lanham

November 14, 2025 AT 03:42And you want me to pay $50 in fees just to move it?

That’s not security - that’s a tax on paranoia.

Maybe I’ll just hold cash. At least it doesn’t need quantum-proofing.

Emily Unter King

November 15, 2025 AT 14:02Crystals-DILITHIUM has undergone 5 years of cryptanalysis by over 150 global researchers.

Its resistance to lattice-based attacks has been formally proven under the Learning With Errors assumption.

Ignoring this is not skepticism - it’s negligence.

John Doe

November 16, 2025 AT 12:25They’ll be weaponized by the NSA to steal it.

And then they’ll blame China.

And then the government will ‘nationalize’ all crypto under ‘national security’.

This isn’t about math - it’s about control.

They want you to panic so you’ll hand over your keys to ‘trusted’ institutions.

Stay vigilant. Don’t move. Don’t trust. Just HODL.

Ryan Inouye

November 17, 2025 AT 08:38You think a ‘hybrid signature’ will save you?

That’s like putting a lock on your front door while leaving your back door open - and then patting yourself on the back for being ‘secure’.

And you’re trusting NIST? The same agency that backdoored the Dual_EC_DRBG?

Don’t be a sheep. The real solution is to leave the system entirely.

Go analog. Use gold. Burn your keys.

Rob Ashton

November 18, 2025 AT 05:23It is not merely a technical evolution - it is a moral imperative to preserve the integrity of decentralized value.

As stewards of this ecosystem, we owe it to future generations to act with diligence, foresight, and collective responsibility.

Let us not be remembered as the generation that ignored the warning signs.

Cydney Proctor

November 19, 2025 AT 19:52Meanwhile, I’ve got a $5000 ETH position in a wallet I haven’t touched since 2021.

It’s not ‘vulnerable’ - it’s a relic. And relics are supposed to be kept in museums, not in your portfolio.

Cierra Ivery

November 19, 2025 AT 22:07Why? Because they’re all centralized in spirit.

What if the ‘quantum-resistant’ algorithm has a backdoor? What if the upgrade is forced? What if they change the rules after we move?

This isn’t security - it’s a Trojan horse dressed in math.

Veeramani maran

November 21, 2025 AT 05:24my btc is in a 1... address

and i thought i was safe bc i never spend it

but now i realize i gave my key to the world

thank u for this post

Kevin Mann

November 22, 2025 AT 19:57What happens? The market crashes. Exchanges freeze withdrawals. Governments declare a crypto emergency. The Fed issues a CBDC that’s ‘quantum-secured’ - and guess what? It’s not decentralized.

And then the entire crypto movement dies - not because of tech, but because of trust.

So yeah - we’re not just fighting quantum computers.

We’re fighting the collapse of an idea.

And if we don’t act now, we won’t even get to argue about it.

🚀 #QRCryptoNow

Kathy Ruff

November 24, 2025 AT 11:43Wallets, exchanges, custodians - they all need to run simulations, build dual-signature support, and educate users.

Waiting for a hard fork is a luxury we don’t have.

Start small. Start now. Even if it’s just one address.

Robin Hilton

November 24, 2025 AT 16:07You spend years learning how it works - then someone drops a bomb like ‘oh by the way, it’s all going to be hacked by a machine that doesn’t exist yet’.

It’s not a currency. It’s a science fair project with a price tag.

Nitesh Bandgar

November 25, 2025 AT 03:28Everyone laughed when I said ‘quantum will kill Bitcoin’.

Now? They’re reading this post like it’s the gospel.

But guess what? I told you so.

And now I’m holding QRL. And I’m not moving. Because I’m not a fool. I’m a prophet.

Jessica Arnold

November 26, 2025 AT 04:51This is that storm.

And we’re all sitting in a glass house, arguing about the color of the curtains.

It’s not about Bitcoin vs Ethereum. It’s about whether we value freedom enough to protect it - even when it’s inconvenient.

Chloe Walsh

November 26, 2025 AT 07:18Meanwhile, my dog has more common sense than NIST.

This is like hiring a teenager to fix your nuclear reactor because he ‘read a book’.

And you’re telling me this is ‘the future’?

Give me a break.

Stephanie Tolson

November 26, 2025 AT 09:49It’s not glamorous. No one’s cheering.

But someone has to do it.

If you’re reading this and you’re holding BTC - go check your address type.

It takes 2 minutes.

And it might save you millions.

Anthony Allen

November 27, 2025 AT 17:23It’s not just about signatures.

It’s about the entire philosophy of decentralization.

If we rely on centralized institutions to force PQC upgrades, we’re already losing.

The real win is if the community self-organizes - wallets, devs, users - to adopt hybrid systems organically.

That’s the true test of crypto’s soul.

Vipul dhingra

November 28, 2025 AT 03:00quantum computers cant even do basic math right

why are you wasting time on this

just buy bitcoin and shut up

Jacque Hustead

November 28, 2025 AT 11:11I’ve seen bull runs, crashes, scams, and hype cycles.

But this? This is the first time I’ve felt real dread.

Not because I’m scared of losing money.

But because I’m scared of losing what this movement stands for.

If we let centralization creep in under the guise of ‘security’, we’ve already lost.

Robert Bailey

November 30, 2025 AT 06:06That’s it.

Don’t overthink it.

Just do the three things.

And sleep better tonight.

Wendy Pickard

December 1, 2025 AT 08:17I’m not a tech person - I just want my money to be safe.

You gave me a roadmap. Not fear. Not hype. Just steps.

I’m moving my BTC today.

Finn McGinty

December 2, 2025 AT 07:54The adoption of post-quantum cryptography within decentralized systems is not merely a cryptographic challenge - it is a profound test of collective governance, institutional legitimacy, and the very ontology of trust in digital economies.

When NIST, a U.S. federal agency, becomes the de facto arbiter of global cryptographic standards for a decentralized network, we are witnessing the quiet colonization of open-source infrastructure by state-aligned epistemic authority.

Hybrid systems, while pragmatically sound, risk normalizing the coexistence of legacy centralized trust models with ostensibly decentralized protocols - thereby undermining the foundational ethos of crypto.

The true solution lies not in upgrading algorithms, but in rethinking the architecture of trust itself - one that is not dependent on any single institution, quantum or otherwise.

Until then, we are merely rearranging the deck chairs on the Titanic - albeit a very expensive one.