XBTS Crypto Exchange Review - In‑Depth Look at Features, Fees & Security

XBTS Trading Fee Calculator

Calculate Your XBTS Trading Costs

Your Trading Cost Analysis

SmartHolder Benefits

When you hear the term XBTS.io is a multi‑chain decentralized exchange (DEX) built on the BitShares blockchain since 2018, you might wonder whether it lives up to the hype. This review breaks down the platform’s core tech, fee model, security posture, and user experience so you can decide if the XBTS crypto exchange fits your trading style.

What XBTS.io Actually Does

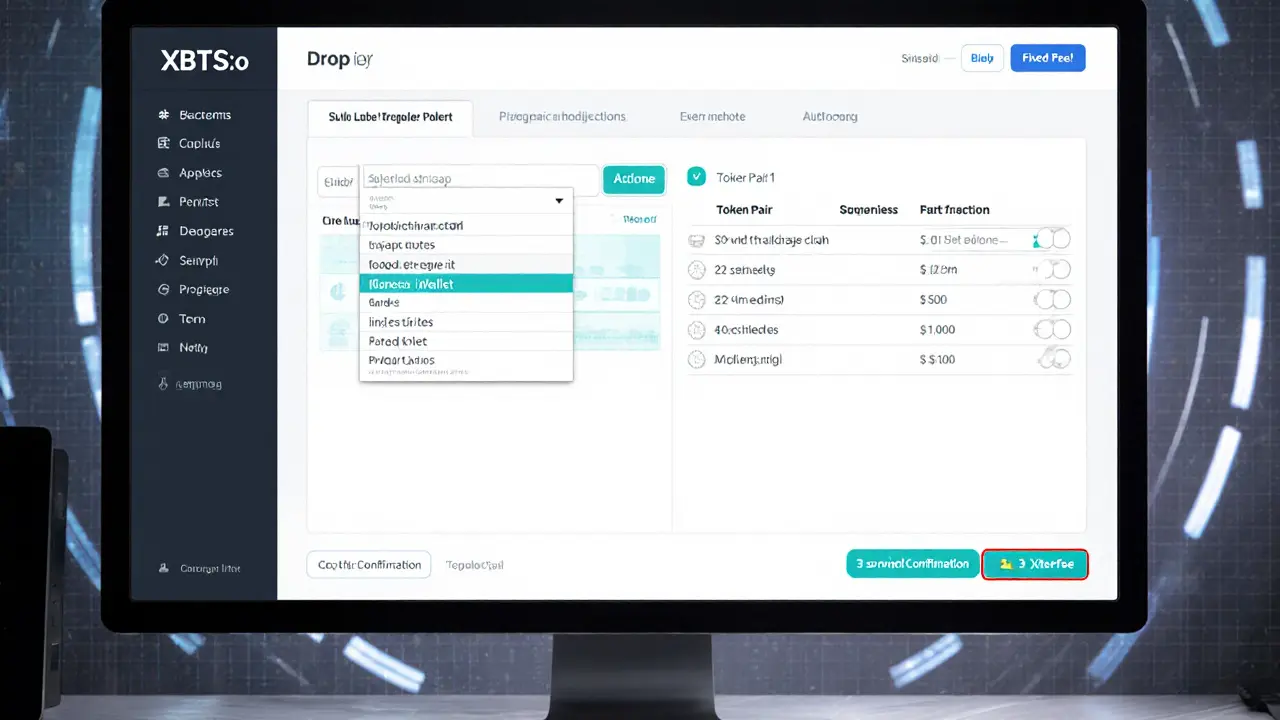

XBTS.io acts as a gateway to the BitShares ecosystem while also supporting dozens of external blockchains. In practice, you download a desktop client for Windows, macOS or Linux, or use the web interface, then connect a wallet such as MetaMask or Trust Wallet. Once linked, you can swap Bitcoin, Ethereum, Litecoin, DOGE, and many niche tokens without leaving the app. The platform’s claim of “instant buy and sell at fair prices” comes from its on‑chain order‑matching engine, which settles trades in roughly three seconds thanks to the underlying DPOS consensus (Delegated Proof‑of‑Stake) used by BitShares.

Key Technical Features

Below are the technical pillars that make XBTS.io different from a typical centralized exchange:

- Multi‑chain support: integrates with wallets like Binance Web3 Wallet, Coinbase Wallet, Phantom, Rainbow, and WalletConnect. This lets you move assets across chains without external bridges.

- Fixed‑fee model: instead of a percentage per trade, fees are paid in BitShares (BTS) or other supported coins. The exact rate isn’t advertised publicly, but users report it feels “very competitive” compared to 0.1‑0.25% on most centralized platforms.

- SmartHolder profit‑sharing: holders of the XBTS token receive 50% of the exchange’s net profit twice a month, paid out in Bitcoin, USDT or other assets. This incentive is highlighted by Revain reviews.

- No KYC requirement: the platform works in roughly 99% of countries without identity verification, making onboarding a matter of minutes.

- Data feeds: price data is sourced from aggregators like CoinGecko, CoinLore, CoinMarketCap and Hive, ensuring up‑to‑date market quotes.

Fees, Liquidity and Trading Pairs

Because XBTS.io uses a fixed‑fee structure, you’ll see a small flat charge (often quoted as 0.0005 BTS per trade) regardless of volume. This benefits high‑frequency traders but can feel steep on micro‑trades under $10.

Liquidity is decent for popular pairs like BTC/BTS, ETH/BTS, and LTC/BTS, thanks to “prominent market makers” the platform claims to attract. However, niche pairs (e.g., RDD/STA or STH/EOS) sometimes suffer wider spreads, a common drawback for smaller DEXs.

Security and Compliance

XBTS.io leans on the native security of the BitShares blockchain. Since assets never leave your connected wallet, the exchange cannot seize funds, a benefit highlighted in Cryptowisser’s 2025 review. There is no public audit report, which raises a flag for security‑focused users. The platform’s DPOS model offers fast confirmation (~3 seconds) while preserving decentralization.

The absence of KYC makes the exchange attractive for privacy‑first traders but also means you can’t deposit fiat directly. If you need to move fiat into crypto, you’ll have to use a separate gateway (e.g., a bank‑linked exchange) first.

Pros and Cons at a Glance

| Pros | Cons |

|---|---|

| Fast 3‑second confirmations via DPOS | Limited mainstream awareness - few traders know about it |

| No KYC, easy onboarding | Liquidity can be thin on obscure pairs |

| Profit‑sharing SmartHolder program | Fixed‑fee model may be high for tiny trades |

| Broad wallet integration (MetaMask, Trust Wallet, etc.) | No public third‑party security audit |

How XBTS.io Stacks Up Against Competitors

| Feature | XBTS.io | BEX | Binance |

|---|---|---|---|

| Type | Decentralized (DEX) | Decentralized (DEX) | Centralized |

| KYC | No | No | Yes |

| Cross‑chain support | Yes (20+ chains) | Limited | Yes (via Binance Bridge) |

| Fee model | Fixed fee in BTS | Percentage (0.1‑0.2%) | Tiered percentage (0.1‑0.02%) |

| Profit sharing | SmartHolder (50% profit) | None | None |

| Liquidity for major pairs | Good for BTC/BTS, ETH/BTS | Average | Excellent |

User Experience & Support

First‑time users often praise XBTS.io’s “plug‑and‑play” desktop client. The interface is customizable - you can drag‑and‑drop trading pairs, set up price alerts, and toggle between dark/light themes. Support channels include 24/7 live chat, email tickets, and a growing knowledge base that features webinars, live training sessions, and in‑person workshops (as listed on the platform).

Community sentiment, gathered from Revain, is largely positive: newcomers like the “no limits on trading pairs” and “very easy to send coins between blockchains”. The most common criticism is the platform’s low visibility, which can make finding tutorials or peer advice a bit harder.

Final Verdict - Should You Try XBTS.io?

If you value privacy, fast on‑chain settlement, and a profit‑sharing model, XBTS.io is worth a test run. It shines for spot trading across multiple blockchains without the hurdles of KYC. However, if you need deep liquidity for huge orders, want a fully audited security track record, or plan to trade fiat‑paired assets, a larger centralized exchange may serve you better.

Bottom line: treat XBTS.io as a niche DEX that excels for privacy‑first traders and those who like to experiment with less‑common token pairs. Start with a small amount, evaluate the fee impact, and decide if the SmartHolder payouts offset the fixed‑fee structure for your trading volume.

Frequently Asked Questions

Is XBTS.io safe to use without KYC?

Safety comes from the underlying BitShares blockchain, which holds your funds in your own wallet. No KYC means the platform can’t freeze assets, but it also lacks a public audit, so only use amounts you’re comfortable risking.

How are fees calculated on XBTS.io?

Fees are a flat amount, usually quoted in BTS (around 0.0005 BTS per trade). The fee does not change with trade size, which can be cheaper for large swaps but relatively expensive for tiny trades.

What wallets can I connect to XBTS.io?

Supported wallets include MetaMask, Trust Wallet, Binance Web3 Wallet, Coinbase Wallet, Phantom, Rainbow, and any wallet compatible with WalletConnect.

Does XBTS.io offer leverage or margin trading?

No. XBTS.io focuses on spot trading only. If you need leverage, you’ll have to look at derivatives‑focused platforms like BitMEX or Binance Futures.

How does the SmartHolder program work?

Holders of the XBTS token receive 50% of the exchange’s net profit twice a month. Payouts are made in Bitcoin, USDT or other supported coins, automatically credited to the holder’s wallet.

johnny garcia

October 23, 2025 AT 08:06In contemplating the architecture of XBTS.io, one must weigh the dialectic between decentralization and usability. The platform's reliance on the BitShares DPOS offers impressive throughput, yet the absence of third‑party audits introduces epistemic uncertainty. Moreover, the fixed‑fee model, denominated in BTS, presents a deterministic cost structure that aligns with rational‑actor theory. 🤔🚀

Andrew Smith

October 26, 2025 AT 04:42Sounds like a solid option for anyone tired of endless KYC hoops. The instant settlement and cross‑chain support are exactly what the community needs right now. Give it a spin and you might find the profit‑sharing model actually pays off!

Ryan Comers

October 29, 2025 AT 02:18Oh great, another so‑called “decentralized” exchange promising freedom while hiding behind BitShares. It’s just another way for the crypto elite to keep control, but hey, if you love the idea of no‑KYC because you hate regulation, go ahead. 🇺🇸💥

Prerna Sahrawat

October 31, 2025 AT 23:54One cannot help but observe the affectations inherent in the marketing of XBTS.io, a platform that purports to democratize liquidity whilst simultaneously basking in the aura of exclusivity. The very notion of profit‑sharing through the SmartHolder program is couched in the language of egalitarianism, yet its mechanics betray a subtle hierarchy that rewards those already possessing substantial token holdings. Furthermore, the reliance on a fixed fee in BTS, though ostensibly transparent, obscures the true cost to marginal traders, rendering the platform an arena where the affluent thrive. In the grand tapestry of decentralized finance, XBTS.io occupies a niche that is both commendable for its ambition and lamentable for its execution. One must therefore approach with a discerning eye, lest the veneer of innovation mask underlying asymmetries.

Joy Garcia

November 3, 2025 AT 21:30The fact that XBTS.io operates without any public audit should set off alarm bells for any vigilant soul. It’s the perfect recipe for a hidden backdoor, waiting for the shadowy hands of the 99% to be exploited. Remember, when a platform claims “no KYC,” it isn’t just about privacy-it’s about evading accountability.

mike ballard

November 6, 2025 AT 19:06Yo, the cross‑chain bridge integration is on point – think WalletConnect, MetaMask, all syncing via decentralized oracle feeds. The DPOS consensus gives you sub‑second finality, which is 🔥 for high‑frequency scalpers. Just make sure your gas wallet is topped up, or you’ll get stuck in a nonce jam.

Molly van der Schee

November 9, 2025 AT 16:42I understand the appeal of keeping your assets in your own wallet while still accessing a broad market. The trade‑off, however, is the responsibility of security rests entirely on you, which can be daunting for newcomers. Take the time to back up your seed phrase and test small swaps before committing larger sums.

Erik Shear

November 12, 2025 AT 14:18The UI is actually pretty clean and easy to navigate it feels like they listened to user feedback

Tom Glynn

November 15, 2025 AT 11:54Think of XBTS.io as a teaching tool for the modern trader 🌱. It strips away the middleman, letting you learn the true cost of each trade, and the SmartHolder rewards can be a nice morale booster 😄.

Johanna Hegewald

November 18, 2025 AT 09:30XBTS.io lets you trade without KYC, uses a flat fee in BTS, and returns half of its profits to token holders.

Benjamin Debrick

November 21, 2025 AT 07:06Indeed, the platform's architecture-while ostensibly minimalist-betrays a labyrinthine complexity; the fixed‑fee paradigm, expressed in BTS, serves as a veritable double‑edged sword: it simplifies cost calculations yet simultaneously imposes a disproportionately heavy burden upon the marginal trader; additionally, the conspicuous absence of a third‑party audit renders the security posture-if not precarious-certainly debatable; one might, therefore, posit that XBTS.io occupies an ambivalent niche within the decentralized exchange ecosystem.

Anna Kammerer

November 24, 2025 AT 04:42Oh sure, because the best way to protect my funds is to trust a DEX that doesn't even bother to publish an audit report. Nice, just what the internet needed-more opaque financial services. At least the profit‑sharing is a nice touch if you enjoy waiting for vague payouts.

Mike GLENN

November 27, 2025 AT 02:18Navigating the landscape of decentralized exchanges can feel like wandering through a maze without a map, yet XBXS.io offers a few signposts that merit attention. Its cross‑chain compatibility reduces friction for users who hold assets across multiple networks, which is a practical advantage over many siloed platforms. The fixed fee, quoted in BTS, provides predictability, but the cost may become significant for micro‑transactions under ten dollars, a nuance that beginners often overlook. Security-wise, the reliance on the BitShares blockchain ensures that private keys remain under user control, mitigating custodial risks. However, the lack of an independent security audit leaves a gap in confidence that more risk‑averse traders will find unsettling. The SmartHolder profit‑sharing model, while innovative, distributes rewards in proportion to token holdings, potentially reinforcing existing wealth disparities. User experience is bolstered by a customizable UI and responsive support channels, though the community’s relative obscurity can make finding peer guidance a challenge. Ultimately, the exchange serves best those who value privacy and are comfortable managing their own security.

Paul Barnes

November 29, 2025 AT 23:54If you think the flat fee model is revolutionary, think again; it simply shifts cost structures without solving liquidity issues.

John Lee

December 2, 2025 AT 21:30When I first opened XBTS.io, the interface greeted me with an almost unsettling serenity, as if the platform itself were meditating on the chaos of the crypto markets. The dark theme, paired with sleek drag‑and‑drop panels, invites users to curate their own trading battlefield, a feature that feels both empowering and slightly theatrical. Yet beneath this polished veneer lies a financial construct that demands scrutiny, especially regarding its fixed‑fee schema denominated in BTS. The fee, while advertised as “very competitive,” translates to a flat 0.0005 BTS per trade-a figure that can eclipse the nominal profit of a ten‑dollar swap. Moreover, the SmartHolder profit‑sharing mechanism, which doles out fifty percent of net earnings twice a month, resembles a dividend model, but only for those already holding the XBTS token, thereby creating a subtle incentive loop. In practice, this means newcomers may find themselves paying fees without immediate access to the reward pipeline, a dynamic that could deter casual traders. Liquidity, on the other hand, paints a mixed picture; major pairs like BTC/BTS boast respectable depth, whereas obscure token pairings expose sprawling spreads that could erode returns. The platform’s commitment to no‑KYC onboarding is a double‑edged sword: it safeguards privacy for users wary of data collection, yet it also opens doors for potential illicit activity, which regulators may frown upon. Security, anchored in the BitShares DPOS consensus, offers rapid transaction finality, but the conspicuous absence of a third‑party audit leaves an unsettling void in the trust equation. Community support channels, ranging from live chat to webinars, demonstrate a genuine effort to educate users, yet the relative obscurity of XBTS.io means that peer‑to‑peer knowledge exchange remains limited. From a user‑experience standpoint, the customizable alerts and theme toggles are thoughtful touches that enhance usability. Nevertheless, the platform’s limited mainstream visibility means that finding tutorials or expert opinions often requires a deep dive into niche forums. In juxtaposing the platform’s strengths-privacy, speed, profit‑sharing-against its weaknesses-audit opacity, fee structure, liquidity gaps-one sees a balanced, albeit imperfect, offering. For those who prioritize autonomy over convenience, XBTS.io presents a compelling, if not wholly flawless, option. Ultimately, trialing the exchange with modest capital remains the safest pathway to assess its fit for your individual trading strategy.

Jireh Edemeka

December 5, 2025 AT 19:06Ah, the allure of a DEX that promises anonymity while quietly sidestepping standard security checks-truly the pinnacle of modern finance. One can only admire how the developers have managed to perfect the art of saying nothing at all about audits.

Lindsey Bird

December 8, 2025 AT 16:42Honestly, I could write a novel about how overhyped XBXS.io is, but I’m too lazy-so just know it’s another pretty interface with the same old promises.

john price

December 11, 2025 AT 14:18tHe flAt fee be like a trap for newbs, dont think you r rIght, its just a sneaky cost that eats ur profit!

Ty Hoffer Houston

December 14, 2025 AT 11:54I’ve seen a lot of DEXs come and go, and XBTS.io stands out for its cross‑chain flexibility. If you’re new to the space, start with a small amount, explore the wallet connections, and you’ll appreciate the instant settlement.

Ryan Steck

December 17, 2025 AT 09:30dont trust any platform that dont give u a audit, its all a big scam run by the evils in the deep web.

James Williams, III

December 20, 2025 AT 07:06For anyone on the fence, the key takeaways are: fast trades, no KYC, flat fees, and profit sharing. It’s a decent niche DEX if you don’t need massive liquidity.