51% Attack Risk for Small Cryptocurrencies: How Easy It Really Is to Break Them

Imagine you own a small digital currency. It’s not Bitcoin. It’s not Ethereum. It’s something you bought because it was cheap, maybe even under $100,000 in market value. You think it’s safe because it’s on a blockchain - decentralized, unchangeable, secure. But here’s the truth: 51% attack risk isn’t a theoretical concern for small cryptocurrencies. It’s happening right now, and it’s getting easier.

What a 51% Attack Actually Does

A 51% attack doesn’t mean someone steals your coins. It doesn’t hack your wallet. It doesn’t change how many coins exist. What it does is rewrite history. If one person or group controls more than half of a blockchain’s mining power, they can reverse transactions, block new ones, and double-spend coins. That means they can send the same coins to two places - spend them on an exchange, then undo the original transaction, keeping both the coins and the cash. This isn’t sci-fi. In 2018, Bitcoin Gold lost $18 million to a 51% attack. The attackers rented mining power for a few hours, double-spent on multiple exchanges, and vanished. Ethereum Classic has been hit multiple times since 2019. Feathercoin, Krypton, and even Monero - a coin built to resist centralization - have all been targeted. The reason these attacks work on small coins is simple: they’re weak. Bitcoin’s network has over 700 exahashes per second. To control 51% of that, you’d need billions of dollars in hardware and electricity. But a small coin with a hashrate of 100 GH/s? You can rent that power for under $10,000 on a cloud mining site. Some attacks cost less than a used car.Why Small Cryptocurrencies Are Sitting Ducks

Most small cryptocurrencies have three fatal flaws:- Low hashrate: Few miners are interested. The network is too small to attract serious investment.

- Centralized mining pools: Often, 3 or 4 mining pools control 70% of the network. One of them could be compromised - or bought out.

- No monitoring: Big coins have security teams watching for anomalies. Small coins? No one’s watching. An attack can go unnoticed for hours.

What Attackers Can’t Do (And What They Can)

Let’s clear up a common myth: a 51% attacker can’t steal your coins. They can’t change your wallet balance. They can’t create new coins out of thin air. The protocol rules still hold. But here’s what they can do:- Reverse your transaction if it’s still unconfirmed or only 1-2 blocks deep

- Block transactions from specific wallets (like those trying to report the attack)

- Reorganize the blockchain to erase your purchase history

- Double-spend coins on exchanges that accept 1-3 confirmations

Real Cases: When the Money Vanished

In May 2018, Bitcoin Gold was hit. Attackers reversed 38,000 BTG transactions - worth $18 million at the time. The network had to hard-fork to fix the damage. Many users lost funds. Exchanges like Bittrex and Huobi delisted Bitcoin Gold. The coin never recovered its value. In 2020, the same coin was hit again. This time, the attack lasted over 20 hours. Miners abandoned the network. Developers admitted they had no real defense. Monero, designed to be ASIC-resistant and fair for CPU miners, was hit in 2024. A mining pool called Qubic briefly controlled 60% of the network. They reorganized blocks deep into the chain - over 1,000 blocks back - erasing transactions and freezing wallets. Monero’s community scrambled to patch the vulnerability, but trust was already broken. These aren’t one-off events. They’re symptoms of a broken model.Why Decentralization Is the Only Real Defense

The core idea of blockchain is: no single entity should control the network. But small cryptocurrencies often start with just a handful of miners. Some are run by a single team. Others rely on a few mining pools that are owned by the same company. That’s not decentralization. That’s a single point of failure. The only way to stop a 51% attack is to make it too expensive to try. That means:- High hashrate - more miners, more competition

- Diverse mining pools - no one pool has more than 20%

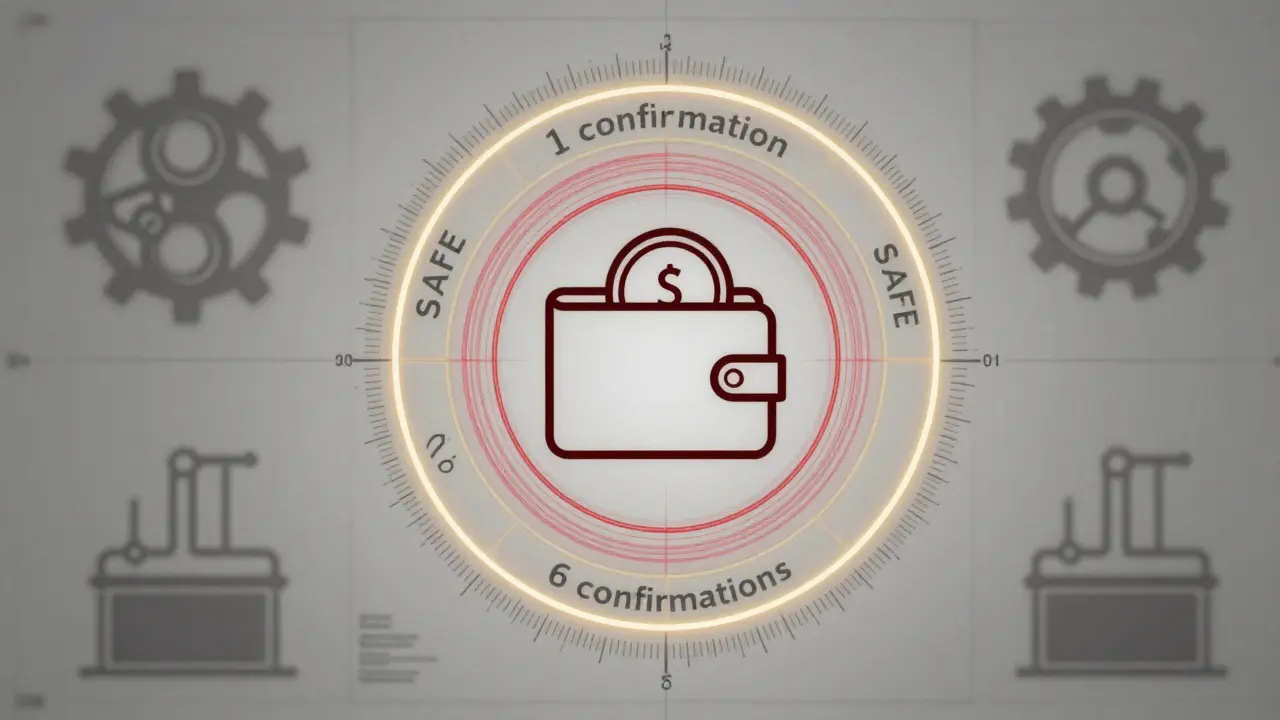

- Longer confirmations - 6+ blocks before large withdrawals

- Checkpointing - trusted nodes freeze the chain at key points

What You Should Do If You Own a Small Crypto

If you’re holding a coin with a market cap under $10 million, here’s what you need to know:- Never trust 1-2 confirmations. Wait for at least 6. If the coin doesn’t have a clear confirmation policy, assume it’s unsafe.

- Don’t use small exchanges. If the exchange doesn’t list Bitcoin or Ethereum, it probably doesn’t have the security to protect you.

- Check the hashrate. Look up the coin on sites like Crypto51.app. If the attack cost is under $50,000, it’s not safe.

- Watch for sudden price drops. If the coin crashes after a big withdrawal, it could be a sign of an attack.

- Assume it’s a target. If it’s not in the top 50 by market cap, it’s on the list.

The Future: More Attacks, Fewer Survivors

As cloud mining gets cheaper and attack tools become more accessible, the number of successful 51% attacks will rise. Industry analysts estimate over 200 small cryptocurrencies are vulnerable today. In the next 12 months, at least 10-15 will be hit hard enough to collapse. The survivors will be those that either:- Have massive hashrate (like Bitcoin or Litecoin)

- Switched to proof-of-stake (like Ethereum)

- Have strong community oversight and rapid response teams

There’s no magic fix. No algorithm can fully protect a coin with too few miners. No marketing campaign can restore trust after a double-spend. The only real protection is scale - and most small cryptocurrencies will never reach it.

Robert Mills

January 27, 2026 AT 18:19Steven Dilla

January 28, 2026 AT 20:34Devyn Ranere-Carleton

January 30, 2026 AT 00:46