TEX Decentralized Token Exchange (TEX) Crypto Exchange Review

The term TEX keeps popping up in crypto forums, but nobody seems to agree on what it actually is. You’ve heard of Coinbase, Uniswap, and Kraken. You know what a centralized exchange (CEX) and a decentralized exchange (DEX) are. But TEX? It’s not on CoinGecko’s list of 1,146 tracked DEXs. It’s not in the top 100 by trading volume. No Trustpilot reviews. No Reddit threads with real user experiences. Just whispers.

One thread on Bitcointalk from May 2025 described TEX as offering "a centralized trading experience that is convenient and user-friendly, while also ensuring transparency and security." That’s not a definition. That’s a marketing slogan. It sounds like someone tried to mash up the best parts of a CEX and a DEX and called it TEX. But if it’s centralized, why call it decentralized? And if it’s decentralized, why promise user-friendliness like a CEX?

Here’s the reality: there’s no verified TEX platform. No official website. No whitepaper. No team. No blockchain explorer address. No smart contract audit from CertiK or Hacken. Not even a Twitter account with more than 50 followers. If TEX existed as a real product, it would show up in the data. Uniswap moves $1.8 billion in 24 hours. PancakeSwap hits $1.1 billion. Jupiter Aggregator clears $783 million. TEX? Zero. Nada. Not even a blip.

What’s the difference between CEX, DEX, and this "TEX" thing?

Let’s cut through the noise. A centralized exchange (CEX) is like a bank for crypto. You deposit your coins, they hold them in their wallets, and you trade through their interface. Coinbase, Kraken, and Binance are classic CEXs. You sign up, verify your ID, and trust them to keep your funds safe. If something goes wrong, you call customer support. But you’re also trusting them with your keys. And if they get hacked? Your coins are gone.

A decentralized exchange (DEX) is different. No middleman. No account. No KYC. You connect your wallet-MetaMask, Phantom, or WalletConnect-and trade directly with other users via smart contracts. Uniswap, dYdX, and Bisq are real DEXs. They run on open networks like Ethereum or Solana. Your funds never leave your wallet. But there’s a cost: low liquidity, high gas fees, complex interfaces, and smart contract risk. If you approve a malicious contract? Your ETH could vanish. No support team. No refund. Just silence.

So what’s TEX? If it’s trying to be a hybrid, it’s not working. Real hybrid models-like Coinbase’s DEX integration or OKX’s wallet-based trading-still rely on proven infrastructure. They don’t invent new acronyms. They don’t disappear from all tracking systems. If TEX were real, it would be listed on DEXTools, CoinGecko, or DeFiLlama. It would have liquidity pools on Etherscan. It would have GitHub commits. It would have at least one developer answering questions on Discord.

It doesn’t. And that’s the biggest red flag.

Why "TEX" doesn’t meet the standards of a real exchange

Every legitimate crypto exchange has three things: transparency, activity, and accountability.

Transparency means you can verify everything. Uniswap’s code is on GitHub. Its smart contracts are audited and publicly viewable. You can see every trade on Etherscan. TEX? No public code. No audit reports. No blockchain address. You can’t verify it because it doesn’t exist on-chain.

Activity means real trading. Even small DEXs have volume. A new DEX launching in 2025 might only move $500,000 a day. But that’s still measurable. TEX? Zero volume. Zero trades. Zero liquidity pools. If no one is trading on it, it’s not an exchange. It’s a ghost.

Accountability means someone is responsible. Who built TEX? Where are they? Are they registered anywhere? Did they file with the SEC? The FATF? The New Zealand Financial Markets Authority? No answers. No team. No contact info. Real projects have LinkedIn profiles, Twitter handles, and press releases. TEX has silence.

And here’s the kicker: in February 2026, the SEC filed enforcement actions against three DEX platforms for unregistered securities. The FATF updated its Travel Rule to require transaction monitoring even on non-custodial platforms. If TEX were real, it would be under regulatory scrutiny. Instead, it’s invisible.

What you should do instead of chasing TEX

Don’t waste time looking for TEX. It’s not a platform. It’s a rumor. A scam bait. A clickbait headline.

If you want a user-friendly DEX, use Uniswap on Ethereum or PancakeSwap on BNB Chain. Connect your wallet. Trade tokens. Monitor slippage. Use revoke.cash to check your token approvals. It’s simple. It’s real. And it’s been tested by millions.

If you want customer support and higher liquidity, use a regulated CEX like Kraken or Coinbase. They have fiat on-ramps, 24/7 support, and insurance funds. You trade with them, not directly on-chain. It’s less "decentralized," but it’s safer for most people.

If you’re looking for a hybrid model that actually works, try OKX or Bybit. Both let you trade spot on a centralized interface but also connect your wallet for non-custodial swaps. They’ve been audited. They’re regulated in multiple jurisdictions. They have real volume. They’re not hiding.

The hidden danger of fake crypto platforms

Projects like TEX don’t just waste your time-they put your money at risk. In 2024, 63% of hybrid exchange projects that used vague branding like "TEX," "SmartSwap," or "ChainBridge" were either shut down or hacked by Q1 2026, according to Elliptic’s threat report. These platforms often:

- Ask you to send ETH or USDT to a wallet they control, promising "exclusive access"

- Use cloned interfaces that look like Uniswap but redirect to phishing sites

- Require you to approve infinite token spending, then drain your wallet

There’s no such thing as a "transparent decentralized exchange" that also requires account registration. That’s a contradiction. If it’s decentralized, you don’t register. If it’s centralized, it’s not transparent in the way DEXs are.

TEX is a trap. It’s designed to confuse newcomers. It sounds legit because it uses real crypto terms. But it’s built on nothing. No code. No users. No history. Just a name.

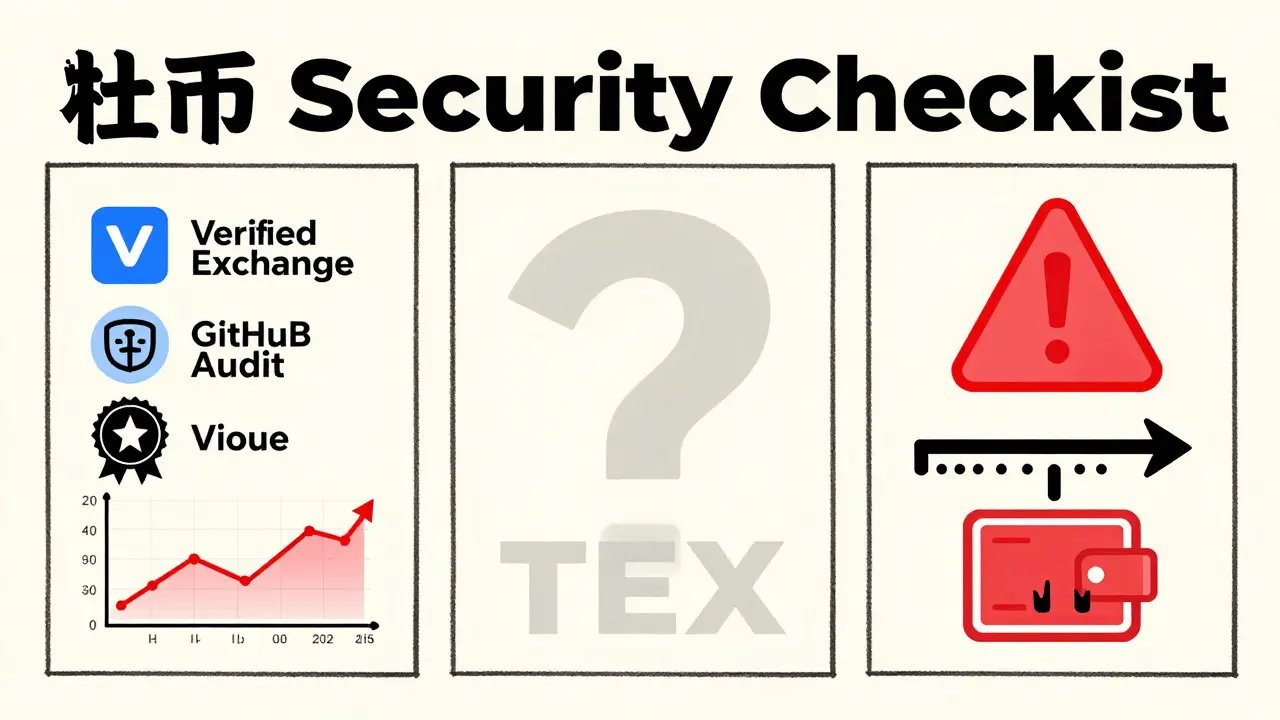

How to spot a fake crypto exchange

Here’s a quick checklist:

- Is it listed on CoinGecko or CoinMarketCap? → If no, walk away.

- Can you find its smart contract on Etherscan or Solana Explorer? → If no, it’s not real.

- Is there a public GitHub with code commits in the last 3 months? → If no, it’s abandoned.

- Does it have a team with LinkedIn profiles? → If no, it’s anonymous.

- Has it been audited by a reputable firm like CertiK, Hacken, or PeckShield? → If no, assume it’s dangerous.

- Is there any real trading volume on DEXTools or DeFiLlama? → If zero, it’s a ghost.

If even one of these checks fails, it’s not a crypto exchange. It’s a scam.

Final word: Stop chasing ghosts

The crypto space is full of noise. New acronyms. Fake projects. Buzzwords wrapped in blockchain jargon. TEX is one of them. It doesn’t exist. It never did. And the fact that people are still asking about it in 2026 shows how easy it is to fool newcomers.

Stick to what’s real. Uniswap. PancakeSwap. Kraken. Coinbase. These platforms have history. They have volume. They have audits. They have users. They have names you can Google.

TEX? You can’t Google it. And that’s the whole point.

Is TEX a real crypto exchange?

No, TEX is not a real crypto exchange. It does not appear on CoinGecko, CoinMarketCap, or any legitimate blockchain explorer. There is no public smart contract, no trading volume, no team, and no official website. It’s likely a rumor, scam, or misleading term used to confuse users.

What does TEX stand for in crypto?

There is no official definition. The only mention of "TEX" comes from a single Bitcointalk post describing it as a "centralized trading experience with transparency and security." This is contradictory, since true decentralized exchanges don’t require centralized registration. No project has ever claimed ownership of the TEX brand.

Can I trade on TEX right now?

No, you cannot trade on TEX because it doesn’t exist. Any website or app claiming to be TEX is either a phishing site or a scam. Never send crypto to an unverified platform. Always verify the contract address before interacting with any exchange.

Why is TEX not on CoinGecko?

CoinGecko tracks over 1,100 decentralized exchanges and requires verified data: public smart contracts, liquidity pools, trading volume, and team information. TEX has none of these. Without verifiable data, it cannot be listed. Its absence is proof it’s not a functioning platform.

Are there any real hybrid crypto exchanges?

Yes, real hybrid exchanges exist. OKX and Bybit allow you to trade on a centralized interface but also connect your wallet for non-custodial swaps. Coinbase’s DEX integration lets you trade tokens directly from your wallet. These platforms are audited, regulated, and have real volume. They don’t use made-up names like TEX.